WWD and BCG teamed up to uncover what matters most to young fashion consumers and how leading brands are adapting to reach them. Their inaugural Future of Fashion Report offers a roadmap for success in a changing market, drawing on insights from over 9,000 consumer responses, 50,000 social posts, and executive interviews highlighting how brands are winning with Fashion’s Next Gen.

GLO

GLOntroduction

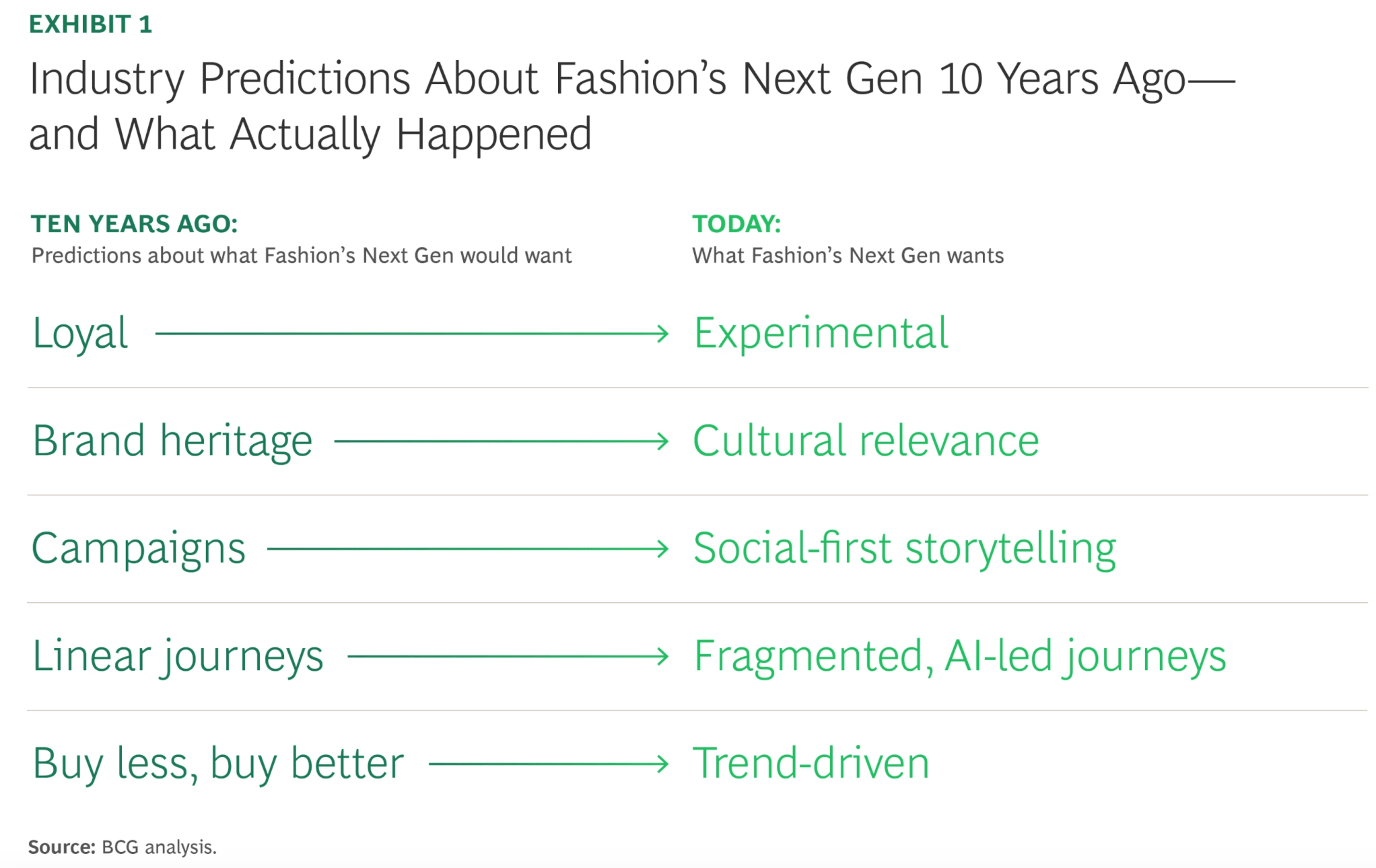

Gen Z and Gen Alpha—together called fashion’s “Next Generation”—are rapidly transforming how the U.S. fashion industry operates. These cohorts are projected to drive more than 40% of fashion spending in the coming decade. Their preferences, values and shopping behaviors differ dramatically from older consumers, forcing brands to rethink everything from product design to marketing to retail execution.

A new report reveals five major shifts defining how these younger shoppers engage with brands—changes fueled by cultural dynamism, social influence, and the rise of AI-driven shopping tools.

Image: BCG

1. The Next Gen Plays by New Rules

Gen Z and Gen Alpha spend a significantly larger share of their budget on fashion—about 7% more than those 29 and older—while spending less on dining and travel.

With limited budgets but a strong desire for self-expression, they want clothing that feels:

-

fun

-

expressive

-

stylish

-

authentic

-

socially influential

They want to stand out and impress their peers, but they are also more price-sensitive than older consumers, leading them to research extensively and comparison-shop to find the best value.

Key Takeaway:

They want expressive fashion at accessible prices—and they won’t overpay for it.

2. Heritage No Longer Guarantees Relevance

Traditional brand prestige means much less to this generation. Cultural relevance now determines whether a brand earns attention.

What captures interest today are:

-

products that feel current and expressive

-

authentic ties to youth culture

-

fast response to trend cycles

-

collaborations and creators that feel “of the moment”

Brands favored by Gen Z and Gen Alpha often gain credibility with older shoppers—but not the other way around. Youth culture now leads the fashion agenda.

Key Takeaway:

Relevance beats history. Brands must participate in culture, not rely on past glory.

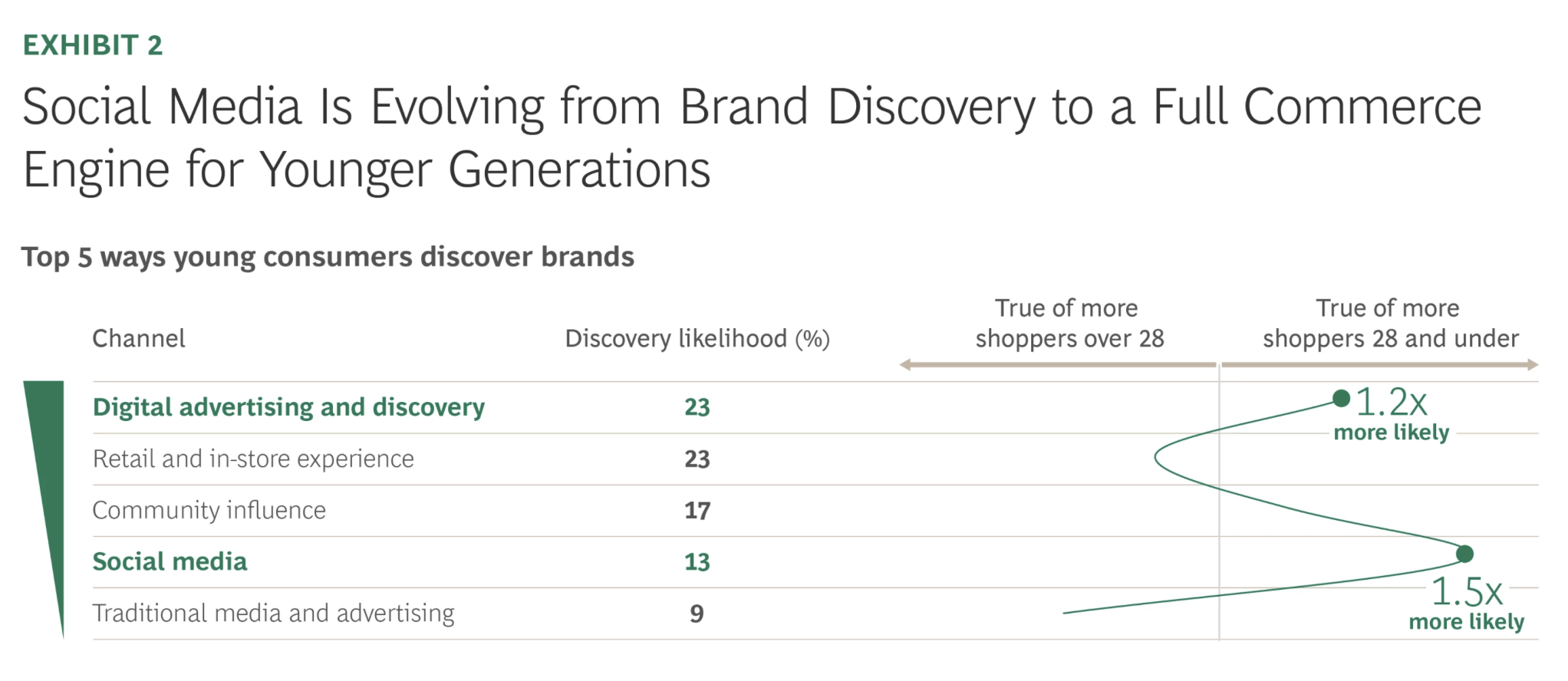

3. Social Media Is the Center of Commerce

For younger consumers, social media is not just inspiration—it is where the entire shopping journey occurs.

Key dynamics:

-

They are twice as likely as older generations to say influencers drive their purchases.

-

Micro-influencers play a major role because they feel more authentic than celebrities.

-

Viral product trends can flare up and fade within one to two weeks, demanding rapid brand response.

-

Social platforms now allow seamless end-to-end checkout, removing friction from discovery to purchase.

Creator-led storytelling now outperforms brand-driven marketing. The result is a shift from traditional campaigns to real-time, creator-fueled product moments.

Key Takeaway:

Social commerce is the new engine of influence and conversion—and it moves fast.

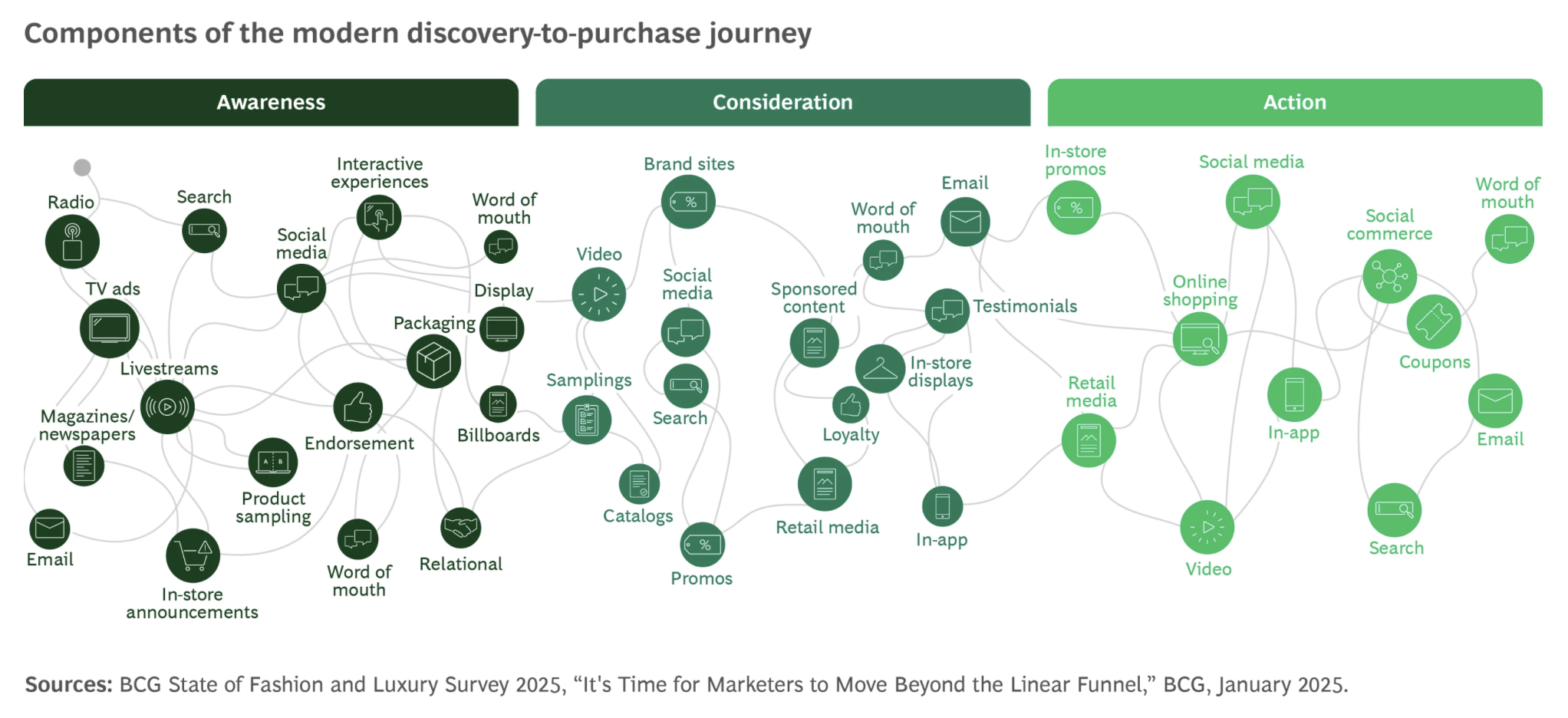

4. AI Has Become a Core Part of the Fashion Journey

AI is reshaping how young consumers discover and evaluate products. About 40% of younger shoppers already use AI tools to:

-

research trends

-

explore new products

-

compare prices

-

receive styling guidance

-

visualize outfits through virtual try-ons

High-spending young consumers use AI daily, making it a central part of their shopping routine.

This shift requires brands to optimize their product content, descriptions and digital presence for AI-driven discovery, where answers—not search results—become the new battleground.

Key Takeaway:

AI is becoming the new personal stylist and shopping assistant. Brands must adapt to stay visible.

5. Young Consumers Are Product-Driven, Not Brand-Driven

Unlike older generations who formed long-term loyalty to specific brands, these younger shoppers care most about:

-

distinct, expressive products

-

price

-

quality

-

resale value

-

versatility for styling

They mix luxury with affordable brands and expect high-touch service—fit advice, styling, personalized recommendations—even at accessible price points.

Key Takeaway:

Strong products win. Quality and value drive decisions more than brand name alone.

Strategies to Win Fashion’s Next Gen

The report outlines five urgent strategies for brands:

1. Define the Next Gen Consumer Clearly

Know which segments matter most and build KPIs around them.

2. Invest in Youth Culture and Creators

Collaborations, cultural relevance and creator partnerships matter more than polished campaigns.

3. Embrace Creator Energy Over Brand Control

Let creators lead storytelling and commerce moments.

4. Prepare for AI-Driven Shopping Journeys

Optimize digital content and product information for AI discovery.

5. Focus on Fundamentals: Price, Quality and Value

Great value and strong product quality remain the biggest drivers of conversion.

Global Loyalty Organisation Take:

Gen Z and Gen Alpha are reshaping fashion through cultural influence, digital-first shopping behavior and rapidly evolving expectations. They demand personalization, authenticity, and value—while moving at the speed of viral culture.

Brands that adapt will capture the next generation of fashion spenders. Those that don’t risk becoming invisible.

The future belongs to brands that can move fast, show up authentically, leverage AI and creators, and—above all—deliver great products at the right price.

Source: BCG

Disclaimer: Press release

© Press Release 2025

Send us your press releases to news@globalloyalty.org

Press releases originate from external third-party providers. This website does not have responsibility or control over its content, which is presented as is, without any alterations. Neither this website nor its affiliates guarantee the accuracy of the views or opinions expressed in the press release.

The press release is intended solely for informational purposes and does not offer tax, legal, or investment advice, nor does it express any opinion regarding the suitability, value, or profitability of specific securities, portfolios, or investment strategies. Neither this website nor its affiliates are liable for any errors or inaccuracies in the content, nor for any actions taken based on it. By using the information provided in this article, you agree to do so at your own risk.

To the maximum extent permitted by applicable law, this website, its parent company, subsidiaries, affiliates, shareholders, directors, officers, employees, agents, advertisers, content providers, and licensors shall not be liable to you for any direct, indirect, consequential, special, incidental, punitive, or exemplary damages, including but not limited to lost profits, savings, and revenues, whether in negligence, tort, contract, or any other theory of liability, even if the possibility of such damages was known or foreseeable.

The images used in press releases and articles provided by 3rd party sources belong to the respective source provider and are used for illustrative purposes in accordance with the original press releases and publications.

Disclaimer: Content

While we strive to maintain accurate and up-to-date content, Global Loyalty Organisation Ltd. makes no representations or warranties of any kind, express or implied, about the correctness accuracy, completeness, adequacy, or reliability of the information or the results derived from its use, not that the content will meet your requirements or expectations. The content is provided “as is” and “as available”. You agree that your use of the content is at your own risk. Global Loyalty Organisation Ltd. disclaims all warranties related to the content, including implied warranties of merchantability, fitness for a particular purpose, non-infringement, and title, and is not liable for a particular purpose, non-infringement, and title, and is not liable for any interruptions. Some jurisdictions do not allow the exclusion of certain warranties, so these jurisdictions may not apply to you. Global Loyalty Organisation Ltd. Reserves the right to modify, interrupt, or discontinue the content without notice and is not liable for doing so.

Global Loyalty Organisation Ltd. shall not be liable for any damages, including special, indirect, consequential, or incidental damages, or damages for lost profits, revenue, or use, arising out of or related to the content, whether in contract, negligence, tort, statute, equity, law, or otherwise, even if advised of such damages. Some jurisdictions do not allow limitations on liability for incidental or consequential damages, so this limitation may not apply to you. These disclaimers and limitations apply to Global Loyalty Organisation Ltd. and its parent, affiliates, related companies, contractors, sponsors, and their respective directors, officers, members, employees, agents, content providers, licensors, and advisors.

The content and its compilation, created by Global Loyalty Organisation Ltd, are the property of Global Loyalty Organisation Ltd. and cannot be reproduced without prior written permission.