During this period, the automotive industry maintained a brand loyalty rate of 50.6%, the same as the corresponding period in 2022, despite a notable 7% increase in return-to-market volume among consumers. This steady loyalty rate is considered a positive indication for the industry, which had been grappling with significant drops in loyalty due to inventory shortages linked to the pandemic. Tesla Brand Loyalty Reaches September Record 71.4%

GLO

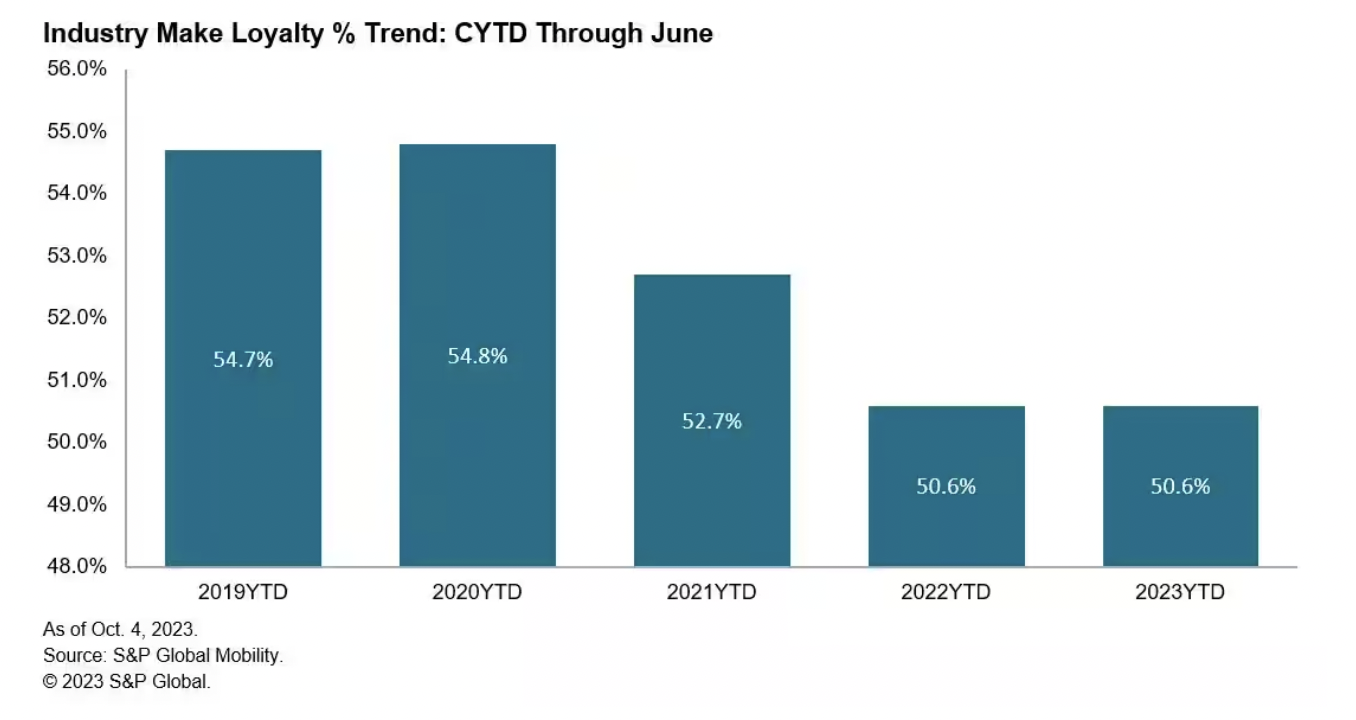

GLOThe trend of declining brand loyalty among U.S. consumers, observed in consecutive year-over-year periods, came to a halt in the first half of 2023, as per the analysis of new vehicle registration data by S&P Global Mobility.

During this period, the automotive industry maintained a brand loyalty rate of 50.6%, the same as the corresponding period in 2022, despite a notable 7% increase in return-to-market volume among consumers. This steady loyalty rate is considered a positive indication for the industry, which had been grappling with significant drops in loyalty due to inventory shortages linked to the pandemic.

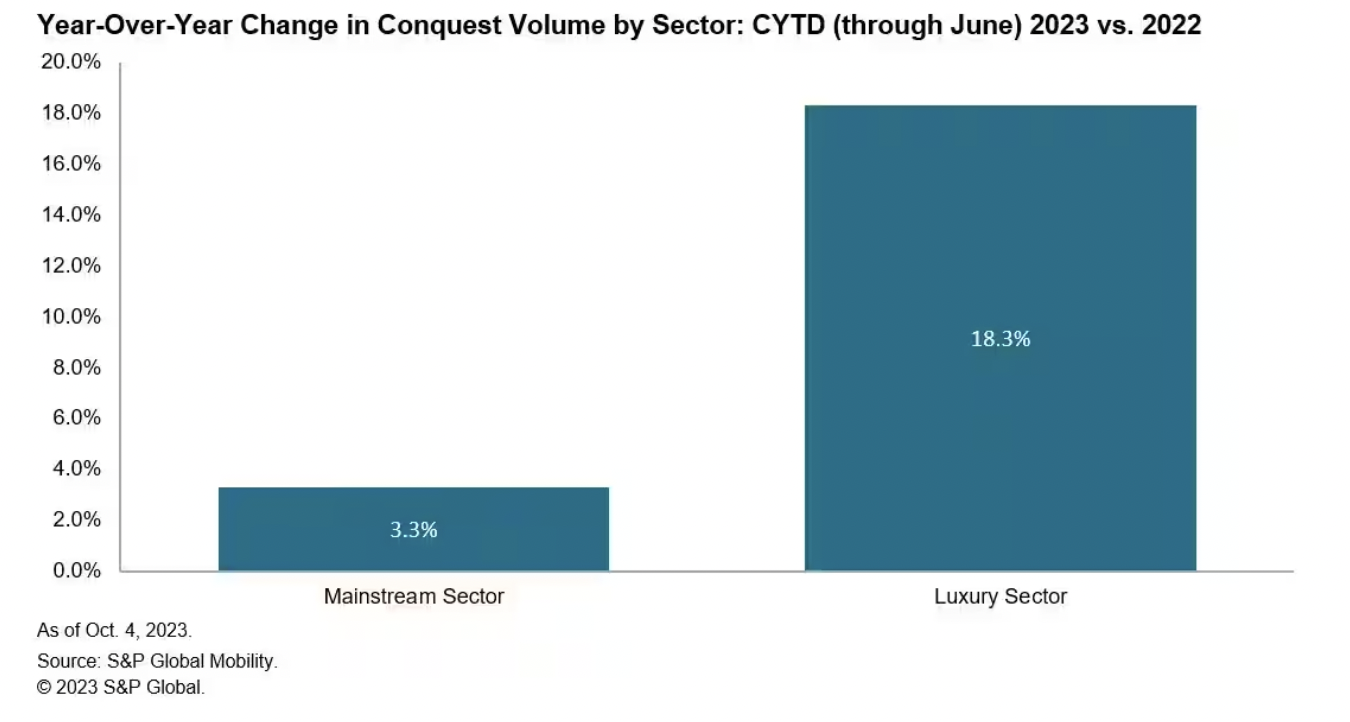

A key factor in arresting the decline was the luxury brands segment, which experienced a 2.7 percentage point (PP) rise in brand loyalty compared to the previous year. In contrast, the mainstream sector, constituting the largest source of consumer return-to-market volume, witnessed a 0.4 PP decrease in brand loyalty during the same period. The availability of inventory played a crucial role in influencing loyalty trends in the first half of 2023.

Vince Palomarez, Associate Director of Loyalty Product Management at S&P Global Mobility, noted, “Increasing inventory levels are helping mitigate the loyalty declines seen in previous years.” However, he highlighted that the recovery of inventory is not uniform across all auto manufacturers, making it challenging to observe significant gains, with some brands benefiting from inventory recovery while others did not.

The increase in conquest volume on a year-over-year basis was a consequence of the stagnation in brand loyalty, rebounding from the decline experienced in 2022. During the first half of 2023, there was a 7% surge in volume compared to the same period in 2022, as consumers, faced with low inventory levels, explored alternatives beyond their usual channels to acquire a vehicle. Tom Libby, Associate Director for Loyalty Solutions and Industry Analysis at S&P Global Mobility, emphasized that recent years have demonstrated that consumers, when in need of a specific type of vehicle, are unwilling to wait for their preferred brand to meet the demand. This shift has created opportunities for lesser-known brands to gain market share from traditional leaders. The industry’s investments in quality and technology have leveled the playing field, enabling smaller brands to capitalize on this trend.

In terms of individual brands, Tesla continues to lead with a loyalty rate of 68.4% for the first half of 2023. Among Tesla’s models, the Model 3 stands out as the frontrunner, with over 74% of returning consumers remaining loyal to the brand, primarily by opting for a Model Y.

Vince Palomarez, speaking on Tesla’s performance, noted the brand’s strong connection with customers despite increased competition in the Battery Electric Vehicle (BEV) market. He highlighted calculated price drops and timely incentive offerings as factors that have enhanced interest and sustained the positive momentum for the Tesla brand.

Additional mid-year highlights include General Motors outpacing last year’s loyalty rate to the manufacturer and leading among multi-brand manufacturers in the first half of 2023. Buick and Land Rover experienced notable gains in brand loyalty, with improvements exceeding 10 percentage points (PP). The Lincoln Nautilus and Ford F-Series emerged as leaders in model loyalty.

Source: S&P Global Mobility