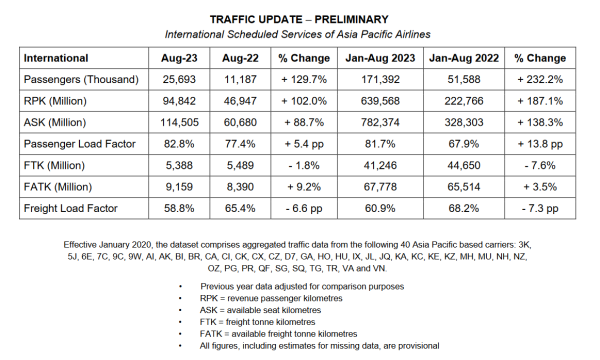

During August, Asia Pacific airlines transported 25.7 million international passengers, marking an impressive 129.7% year-on-year growth compared to the previous year. This brought demand to an average of 76.5% of pre-pandemic levels. In terms of revenue passenger kilometers (RPK), demand saw a year-on-year increase of 102.0%, while available seat capacity also grew by 88.7%. This led to a 5.4 percentage point rise in the average international passenger load factor, which reached 82.8%.

GLO

GLOIn August 2023, the Association of Asia Pacific Airlines (AAPA) revealed encouraging signs of recovery in international passenger markets. This recovery was fueled by strong travel demand and an expansion in city-to-city connections both within and outside the region.

During August, Asia Pacific airlines transported 25.7 million international passengers, marking an impressive 129.7% year-on-year growth compared to the previous year. This brought demand to an average of 76.5% of pre-pandemic levels. In terms of revenue passenger kilometers (RPK), demand saw a year-on-year increase of 102.0%, while available seat capacity also grew by 88.7%. This led to a 5.4 percentage point rise in the average international passenger load factor, which reached 82.8%.

However, the air cargo markets experienced a setback due to renewed declines in export orders. Demand, measured in freight tonne kilometers (FTK), saw a slight 1.8% year-on-year decrease in August compared to the subdued volumes recorded in the same month last year. The international freight load factor faced pressure, registering a 6.6 percentage point decline to an average of 58.8% for the month, despite a 9.2% year-on-year increase in offered freight capacity.

Commenting on these results, AAPA director general Subhas Menon stated: “Despite the moderation in global economic activity, demand has continued to grow in the services sectors, including travel and tourism. Against this background, Asia Pacific airlines saw a healthy 232% increase in the number of international passengers carried to a combined 171 million during the first eight months of the year.”

“On the other hand, the same period saw Asian airlines record a 7.6% decline in international air cargo demand, reflecting prevailing weakness in international trade flows. In addition, the normalization of container shipping rates affected demand for air shipments of non-time-sensitive goods.”

Looking forward, Menon mentioned, “Forward booking trends indicate resilient travel demand in the coming months. While this bodes well for the passenger business segment, airlines face higher costs driven by inflation and the recent rise in jet fuel prices, which threaten to squeeze margins. Delays in aircraft deliveries and parts shortages may affect airline fleet deployment plans. Competition is also intensifying in tandem with the increase in capacity globally. Asian airlines remain focused on efforts to increase productivity, as the industry strives to return to profitability following three consecutive years of heavy losses.”

Source: TTR Weekly