Qantas Loyalty continued its strong performance delivering an Underlying EBIT of $451 million, with points earned and redeemed exceeding pre-COVID levels. The result demonstrates the program’s unrivalled proposition with approximately one million new members joined in the last 12 months and an estimated one in five Australian SMEs6 now part of Qantas Business Rewards.

GLO

GLO

Chairman’s Message highlights:

“This past year has been extremely challenging on a number of fronts — both for our company and many of our stakeholders… We had significant issues as Qantas and Jetstar’s flying ramped up post-COVID, with supply chain and resourcing challenges resulting in too many cancellations and delays. It was deeply disappointing and we sincerely apologise. Our people worked incredibly hard to fix this, and by the end of the year Qantas was the most on time of the major domestic airlines for 11 out of 12 months. Demand for travel has been very strong and our flying increased to carry 46 million people — more than twice the number we carried the year before. Importantly, our operational safety performance across the Group was strong, and this will always be our top priority.

We took delivery of 10 new aircraft during the year as we started a decade-long renewal program of our jet fleet. Over the next three financial years alone, we’re investing around US$4.3 billion in a mix of wide and narrow-body aircraft, which will open up new domestic and international routes. These aircraft also burn around 20 per cent less fuel, helping us towards our interim net emissions reduction targets for 2030.”

“We have a pipeline of investment that will improve what we deliver for our customers – from new aircraft to new routes and new lounges. We are making significant investment in digital technology that will put more power in the hands of our people and passengers. And we continue to grow Qantas Loyalty and Qantas Freight. Our ability to invest comes from a strong balance sheet and strong travel demand, which means we can also keep delivering returns to shareholders.”

Results Highlights:

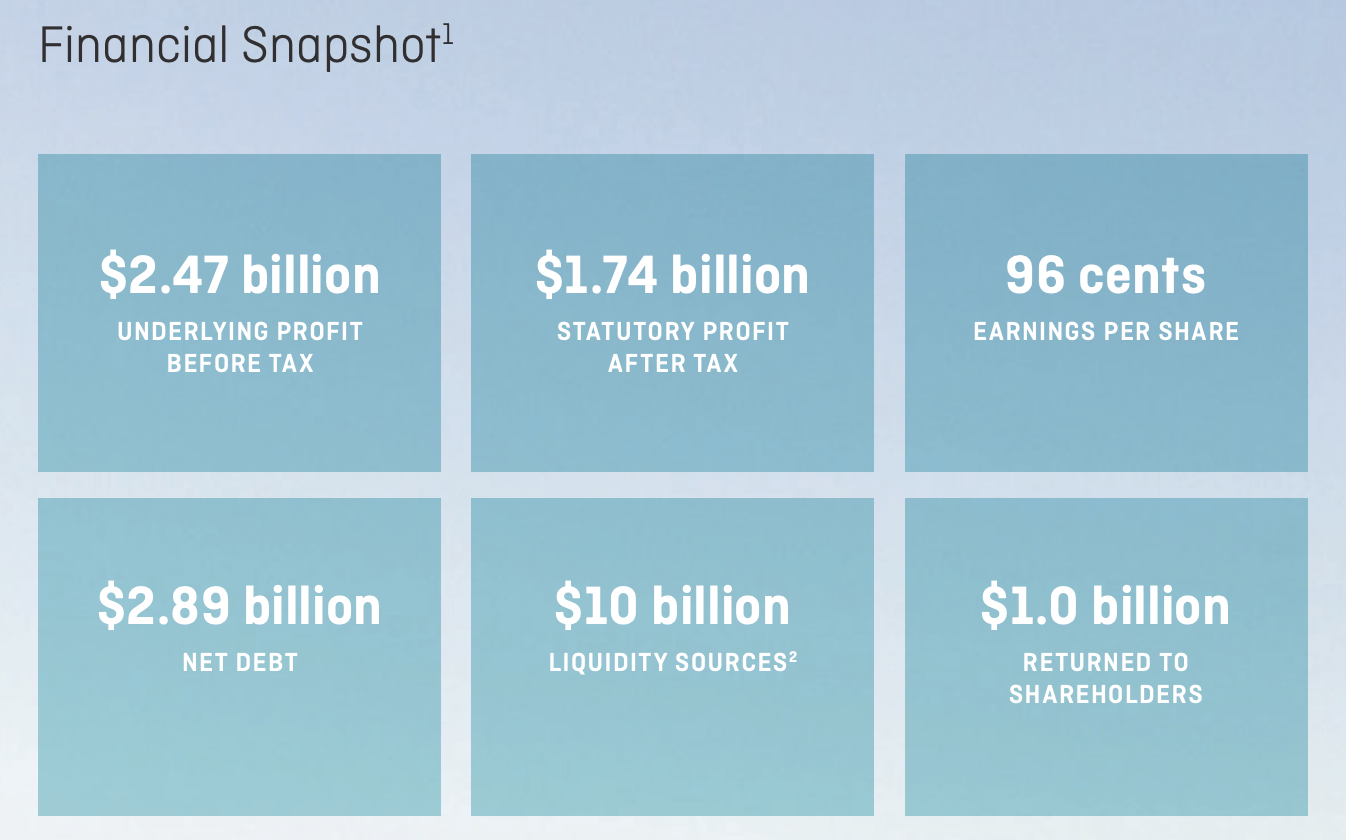

The Qantas Group (referred to as the Qantas Group or the Group) reported Underlying Profit Before Tax1 (Underlying PBT) of $2,465 million for the financial year 2022/23, a significant turnaround from the Underlying Loss Before Tax of ($1,859) million in financial year 2021/22. The result was underpinned by Group capacity (ASKs2 ) returning to 77 per cent of pre-COVID levels in financial year 2022/23, ongoing strength in travel demand, and the completion of the Group’s three-year Recovery Plan, including delivery of $1 billion in permanent cost benefits.

The recovery of Group capacity for financial year 2022/23 was driven by Group Domestic ASKs returning to 96 per cent of pre-COVID levels and Group International ASKs back to 67 per cent of pre-COVID levels. Whilst the impacts of COVID-19 have abated, the Group continued to experience industry recovery challenges which adversely affected operations. These included aircraft manufacturer delays, supply chain dislocations, constrained labour availability and training, and limited heavy maintenance slots at MROs3 . Significant investments were made during the year to build up resilience against these factors, resulting in temporary costs and inefficiencies which are expected to unwind into financial year 2023/24.

The Group’s Statutory Profit Before Tax was $2,472 million, improving by $3,663 million compared to the financial year 2021/22, with the Statutory result including $7 million of net benefits, which were not included in Underlying PBT. Statutory Profit After Tax was $1,744 million. For Group Domestic operations, the dual brand strategy continued to be core to the Group’s strategic proposition, with leadership across all key segments of the market. Qantas Domestic delivered an Underlying EBIT of $1,270 million, achieving an EBIT margin4 of 18 per cent. Jetstar Domestic delivered an Underlying EBIT of $255 million, achieving an EBIT margin of 11 per cent. The Group Domestic EBIT margin of 16 per cent was underpinned by cost transformation, structural network changes and strong leisure demand.

The Group’s International operations (including Freight) contributed an Underlying EBIT of $1,055 million. Rapid return of demand and a gradual recovery in industry capacity resulted in strong Unit Revenue5 performance substantially above pre-COVID levels. As expected, this unit revenue performance moderated in the second half as capacity progressively returned. The contribution from Qantas Freight, approximately $150 million higher than pre-COVID periods, moderated from record levels in financial year 2021/22 as yields normalised and passenger aircraft belly capacity returned.

Qantas Loyalty continued its strong performance delivering an Underlying EBIT of $451 million, with points earned and redeemed exceeding pre-COVID levels. The result demonstrates the program’s unrivalled proposition with approximately one million new members joined in the last 12 months and an estimated one in five Australian SMEs6 now part of Qantas Business Rewards. Within the Loyalty ecosystem the coalition of partners now exceeds 700 with this depth of engagement delivering over $2 billion in gross cash receipts in financial year 2022/23.

Other key financial metrics for the 2022/23 financial year include:

– Earnings Per Share of 96 cents per share

– Group operating margin of 14 per cent

– Three-year Recovery Plan complete, delivering $1 billion of permanent cost benefits

– Qantas Domestic and Qantas International (including Freight) achieving EBIT margins of 18 per cent and 12 per cent respectively

– Operating cash flow of $5.1 billion, driven by structural change in earnings and working capital rebuild

– Net Free Cash Flow of $2.5 billion.

The Group’s Financial Framework remains core to the Group’s strategy, driving sustainable financial strength to support investment and shareholder returns whilst preserving financial flexibility. As at 30 June 2023, Net Debt under the Financial Framework was $2.89 billion, below the Group’s target range of $3.7 billion to $4.6 billion.

During the year, the Group completed $1 billion of share buy-backs at an average price of $6.19 per share. With all pillars of the Group’s Financial Framework met, the Board resolved to distribute further surplus capital to shareholders, announcing a further on-market share buyback of up to $500 million.

Group Performance:

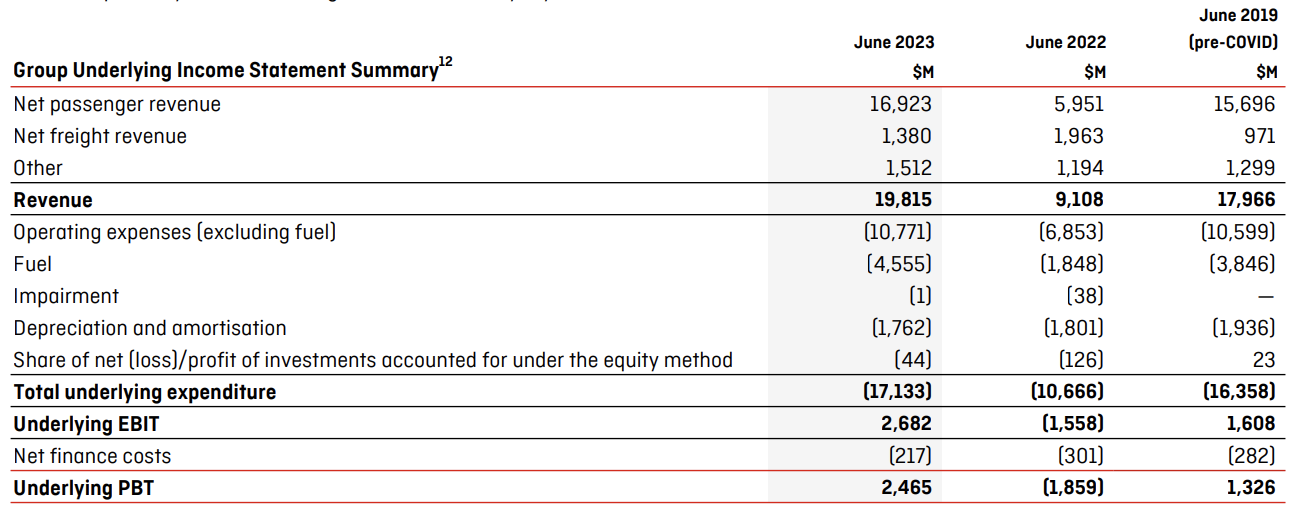

The Qantas Group reported an Underlying Profit Before Tax of $2,465 million for the 2022/23 financial year, a significant turnaround from the Underlying Loss Before Tax of ($1,859) million in the financial year 2021/22. Net passenger revenue increased by 184 per cent with the return of domestic and international operations. Net freight revenue decreased due to a moderation in record yields achieved in financial year 2021/22 as international belly space capacity returned and other revenue increased primarily due to revenue growth at Qantas Loyalty.

Qantas Loyalty:

Qantas Loyalty reported an Underlying EBIT of $451 million, with strong travel recovery underpinning an uplift in member engagement and points earned and burned exceeding pre-COVID levels. The strength of the program was reflected in membership growth, with more than one million new members in the last 12 months.

Momentum continued as the business saw record points earned on financial services products, with spend on Qantas Points-earning credit cards greater than 110 per cent of pre-COVID levels, and approximately 250,000 new cards acquired, up 65 per cent relative to financial year 2021/22. Qantas Point earning credit cards continue to maintain approximately 35 per cent of all consumer spend on credit cards. Airline redemption activity was approximately double relative to financial year 2021/22, with redemption activity returning to 117 per cent of preCOVID levels.

In addition, Qantas Loyalty generated more than $1 billion in new bookings across Hotels, Holidays and Tours, up 90 per cent relative to financial year 2021/22, following the expansion of the Qantas Holidays brand and increased redemption value since February 2022. Since the expansion, members have received increased redemption value, giving members substantially more value on Qantas Hotels and Holidays. Other highlights in the portfolio include 41 per cent growth in health insurance customers and greater than 60 per cent growth in travel insurance policies sold relative to financial year 2021/22. Qantas Business Reward members have grown 19 per cent to approximately 450,000 members, capturing one in five Australian Small and Medium-sized Enterprises (SME) relative to financial year 2021/22.

Qantas Loyalty is committed to growing its member base through broader and deeper program engagement, maintaining strong member engagement through initiatives, including the expansion of Hotel and Holiday offerings and status extensions for Qantas Frequent Flyer members at Silver tier and above.

Source: Qantas Group

full report available here