The 11 providers that matter most and how they stack up based on 29 criteria. The companies mentioned are:

GLO

GLOCustomer Analytics Is About Much More Than Models

- Incorporate data science, behavioral science, design, and engineering. A few years ago, vendors could excel in this market by amassing the biggest army of data scientists. This is no longer the case, as every vendor in this evaluation has a deep bench of data science talent. But building a model is only one part of creating value with customer analytics. The key to success is to embed the insight from the model into an employee or customer experience in a way that changes behavior. For example, Fractal Analytics, despite having “analytics” in its name, emphasizes the importance of design and engineering over analytics.

- Offer relevant, market-tested vertical- and horizontal-specific accelerators. No client wants to be a guinea pig, paying for their customer analytics provider to build solutions from scratch. Accelerators have become de rigeur in this market to demonstrate vendor expertise and accelerate time to value. However, accelerators exist on a spectrum — from snippets of reusable code requiring onerous customization to fully baked applications with a client-ready user interface. Prioritize vendors who have well-developed accelerators for your industry and your specific use case. For example, Tredence offers an out-of-the-box CX control tower that measures, diagnoses, and manages customer experiences in a variety of industries.

- Apply generative AI to real enterprise use cases. Generative AI seems to be everything, everywhere, all at once, but scaled enterprise adoption of the technology is still a rarity. Look for a provider that has live use cases at enterprise scale. A number of the providers in this evaluation are leveraging generative AI to deliver value to clients across the phases of the customer insights lifecycle. For example, ZS is leveraging generative AI for a quick service restaurant (QSR) client to help generate some of the two million emails it sends to customers each week. And Tiger Analytics is using the technology to surface insights on customer behavior for a cosmetics client.

Evaluation Summary

Vendor Profiles

Leaders

- Fractal Analytics fuses analytics, engineering, and design to deliver value. Fractal Analytics (Fractal) has an equation summarizing its approach to customer analytics (and reflecting its mathematical roots): Results equal analytics times engineering squared times design squared. In other words, in Fractal’s vision, analytics is a minor piece of the equation. It’s also the piece that’s most commoditized in this market, so Fractal correctly differentiates itself with its emphasis on design and engineering, which help clients bridge the insights-to-action gap. Fractal’s innovation approach reflects this ethos with dedicated funding for research and development in generative AI and neuroscience that should strengthen its leadership position. Fractal has successfully productized many of its analytical offerings, allowing for software-as-a-service (SaaS) subscription-based pricing on top of traditional services pricing models.

Fractal excels at a variety of customer analytics techniques and applications across industries. Its customer genomics platform is a true personalization engine that leverages multiple analytical models to determine the next best experience for customers. From a CX perspective, its automated insights for digital evaluation (AIDE) platform excels at uncovering digital friction. Unlike other vendors evaluated, Fractal does not own proprietary data and approaches customer data enrichment through partnerships. It shines at the other end of the insights lifecycle, driving effective action through robust decision optimization and insights activation. Reference customers were highly satisfied with Fractal’s ability to deliver insights but less so with its lack of formal data literacy training. Enterprises seeking a partner in their insights-driven transformation should consider Fractal.

- Tredence transforms CX through industry-specific analytical expertise. Tredence has gone from “new kid on the block” to established leader during its relatively short 10-year history in the customer analytics space. The company’s vision to enable true CX transformation includes not only customer-facing functions, but other necessary operational domains such as pricing and merchandising as well. Tredence leverages its Atom.AI platform to routinely develop new verticalized accelerators using cutting edge techniques, a strategy that will aid its continued market success. It has also gained prominence within its partner ecosystem, earning top accolades from technology providers like Microsoft and Databricks, and has developed many joint solutions for customer analytics.

Tredence offers superior customer data management capabilities though Customer Cosmos, an accelerator containing 10 verticalized and over 40 domain-specific customer data models. Cosmos’ vertical nuance enables the provider to excel at customer analytics use cases such as personalization and retention. In addition, Tredence offers strong vertical and domain specific consulting services, identifying and capitalizing on new opportunities such as retail media networks. While reference customers identified areas for improvement in Tredence’s change management tools and services, the vendor received a perfect score on likelihood to recommend. Enterprises looking to transform CX across functional areas of the business leveraging cutting edge analytics should consider Tredence.

- Quantium quickens innovation and value realization through strong partnerships.To achieve its stated purpose to “forge a more insightful world,” Quantium employs over 1,000 data scientists, engineers, product managers, and consultants. The provider’s strong collaborative approach to innovation is evidenced by successful joint ventures with Australia’s largest retailer (Woolworths), bank (Commonwealth Bank), and telco (Telstra). The vendor has also successfully productized several analytical assets such as its Q.Checkout product for analyzing retail transactional and customer data, which gives it an enviable revenue stream from SaaS subscription-based pricing. In a people-centric business, Quantium takes talent development seriously and is consistently one of the top employers in Australia. It has made significant strides in expanding its global delivery model over the past few years, growing its presence in the US, Europe, and India.

Quantium is one of two providers in this evaluation that demonstrated the ability to forge valuable privacy-preserving data partnerships between clients — it helped the Commonwealth Bank of Australia and Telstra share data to protect shared customers from phone fraud scams. It also excels at business consulting with deep industry expertise in retail and consumer packaged goods (CPG), financial services, health, and telecommunications. It is committed to environmental, social, and corporate governance (ESG) principles and has an ethics panel that reviews all projects. In terms of customer analytics applications, Quantium lags in customer experience and contextual marketing because it does not offer an accelerator for natural language processing (NLP). Client references were very satisfied with Quantium’s external and proprietary data enrichment capabilities. Quantium is a strong choice for companies looking for an enduring partnership with a growing analytical powerhouse.

- Tiger Analytics assembles analytical skyscrapers out of reusable Lego blocks.Tiger’s philosophy is one of open IP, and the provider’s aim is to be its clients’ “most collaborative partner” in AI and analytics services. To do this, it employs proprietary “Lego block” accelerators in machine learning and other aspects of the analytics lifecycle to build custom solutions its clients ultimately own. While Tiger’s vision of “delivering actionable insights” to clients is standard, the provider demonstrates a strong approach to talent development, resulting in high employee satisfaction scores and a low employee attrition rate. The firm also has a strong “follow the sun” delivery model that leverages onshore, near-shore, and offshore resources to expand the number of productive hours in a day for its clients.

Tiger has invested in the development of industry-specific assets, and its verticalized customer data models are differentiated in their use of graph and relational representations. The provider also excels at personalization through its journey intelligence and activation platform, a recent innovative personalization solution built with its “Lego blocks.” Tiger excels at adopting emerging analytical techniques for clients and showcased a reinforcement learning-based solution for promotions optimization in CPG and a computer vision-based solution for retail planogram evaluation. Tiger continues to excel at engagement success factors with its value capture methodology and proprietary tools for project management. As a result, Tiger’s client references were highly satisfied with its capabilities across the board. Companies looking for a trusted, open partner that can build a custom analytical solution should consider Tiger.

Strong Performers

- ZS zags beyond its healthcare roots with strong personalization capabilities. Over its 40-year history, ZS has largely served clients in healthcare and life sciences. While it maintains its strong presence in these verticals, the provider has recently made strong inroads in technology, telecommunications, retail, financial services, travel, and CPG. While the company’s vision to decrease time to value and improve analytical operationalization addresses key pain points in the market, it is undifferentiated from most other vendors who preach the same thing. The company does differentiate with its pricing model, offering SaaS solutions such as Personalize.AI. Its 29 delivery centers give ZS global coverage with dedicated resources in almost every major market. ZS could improve its talent strategy, as it lags others evaluated in terms of formalized employee development programs.

ZS excels at personalization. Personalize.AI leverages multiple models to deliver the next best action or experience to customers. ZS has successfully deployed it for a wide range of clients from airlines to QSRs. The provider is also quick to adopt emerging techniques and is leveraging generative AI to deliver personalized emails. Given ZS’s strong machine learning capabilities, it also offers a full-fledged machine-learning operations (MLOps) platform that tracks not just drift but also utilization, cost, and other necessary model health metrics. Client references were very satisfied with these capabilities. ZS does not offer any proprietary data for enrichment and offers no formal training in data literacy. That being said, companies looking to personalize experiences with best-in-breed techniques should consider ZS.

- TTEC thrusts the tip of the spear to capture deep customer value. TTEC consists of two lines of business: TTEC Engage, its classic business process outsourcing (BPO) offering, and TTEC Digital, the insights-driven consulting and technology offering where customer analytics resides. Its vision that “conversations are the currency of customer satisfaction” likely resonates with CX leaders more than marketers, who tend to think in terms of interactions or transactions. TTEC takes a strong approach to talent strategy, delivering almost 1,000 analytics-related courses through its TTEC Talent Training Platform. With its BPO roots, TTEC offers a truly global delivery model with a massive pool of resources spanning six continents. TTEC also boasts many accolades across a robust partner ecosystem and engages in outcomes-based pricing more than other vendors in the evaluation because it often owns insight implementation through TTEC Engage.

Differentiating in this market on data sources and types is difficult. However, TTEC manages to do it with its data annotation and training services. In terms of insights activation, clients utilizing both sides of TTEC’s business benefit from the fact that TTEC Digital can deliver the insights it produces directly through TTEC Engage’s sales and service representatives, circumventing many of the common change management issues other vendors face when handing off analytics to client users. TTEC lacks some of the verticalized analytical accelerators necessary for customer acquisition and retention, and reference customers were lukewarm on its decision optimization capabilities. But TTEC has a strong MLOps capability in its humanify insights platform that can even validate third-party models. Enterprises looking to drive insights into both human and digital interactions should look to TTEC.

- Evalueserve evolves its offering beyond B2B2C. Evalueserve has historically thrived on delivering customer analytics in B2B and highly nuanced B2B2C industries such as industrials and asset management. However, thanks to referrals from satisfied clients it has landed significant B2C clients over the past two years. Its vision, to partner with clients “from ideation to impact” and to emphasize the last-mile adoption of analytics, is standard among vendors in this category. Like other vendors, Evalueserve formally invests in innovation. Its AI for research and analytics program has yielded MagnifAI, a multiproduct platform for marketing and customer analytics. Evalueserve is set up for global delivery across time zones, with onshore resources in most major markets and near-shore and offshore resources located across the globe.

Evalueserve excels at insights delivery, enabling cross-functional insights collaboration to clients through an intuitive user experience (UX) on its MagnifAI platform. Its analytical control tower, which helps clients prioritize, implement, and measure the impact of analytics across the business domains, is a testament to the provider’s strong functional expertise. The provider also offers strong data literacy training to clients as well as its own internal resources through Evalueserve University, which offers courses for executives, operational resources, and technical resources. Evalueserve’s customer data models are primarily limited to B2B industries and marketing use cases. It also doesn’t exhibit the same aptitude for emerging techniques (e.g., reinforcement learning) as its competitors and takes an ad hoc approach to MLOps. Nevertheless, client references were all extremely likely to recommend Evalueserve to peers. Evalueserve is a strong choice for B2B, B2B2C, and even B2C companies looking to leverage customer analytics for marketing optimization.

- EXL executes with vertical expertise and a focus on responsibility. EXL has built a thriving customer analytics business on top of its BPO roots in key industries such as financial services, healthcare, retail, and entertainment (where it enjoys an enviable client roster of major sporting leagues). Its vision, however, is to help clients become “data led,” an anachronism in the current world of insights, outcomes, and artificial intelligence. Its approach to innovation is on par with others. Adjacent acquisitions, such as its purchase of Clairvoyant, a data engineering and cloud enablement provider, have strengthened its market position. The provider offers flexible and innovative pricing models. For example, price is tied to both volume and client outcomes for its SaaS-based Paymentor collections optimization solution.

EXL has strong vertical expertise, with over 300 senior industry subject matter experts to lead engagements. Unfortunately, this verticalization doesn’t percolate down to its customer data models where the vendor leverages accelerators in a more generic approach. The vendor also puts less emphasis on CX use cases but has strong accelerators for acquisition as well as for retention, where it recommends the optimal path to reengagement. EXL differentiates itself with solid, responsible AI practices. It has an AI governing board with project veto power and uses best-in-class tools for explainability and fairness; client references were extremely happy with its responsible AI practice. Enterprises looking for a provider that blends deep industry understanding with responsible analytical practices should consider EXL.

Contenders

- Merkle merges tech and analytics, mostly for marketing. Dentsu-owned Merkle, long a marketing agency powerhouse, aspires to be a “customer experience transformation partner” with its customer analytics offering. In reality, the offering’s emphasis is on customer acquisition. The provider employs over 3,000 data scientists but doesn’t have formalized analytics training for continued employee development. Like others in this evaluation, Merkle has a robust partner ecosystem with hyperscalers and leading platforms such as Adobe and Salesforce. The provider also formally invests in innovation in analytics, data management, and technology, but its recent innovations like data clean rooms are primarily marketing focused rather than CX focused.

Merkle shines at the challenging task of customer acquisition. Clients can append its proprietary asset DataSource, which contains 3,000 attributes and covers 98% of US households, to their own first-party data using Merkle’s ID Graph. Thanks to this data, Merkle is able to help clients perform the daunting task of merging attitudinal segments with behavioral ones, a differentiated approach to acquisition. Merkle does not fare as well at the other end of the customer lifecycle, lacking industry-specific accelerators for customer retention. Also, despite its clear ability to implement marketing campaigns, Merkle lags at insights activation due to its inability to develop insights-infused apps for clients. Merkle thrives on measuring impact and provides proprietary tools and frameworks for measurement. Marketers looking to grow their business primarily through acquisition of US customers should consider Merkle.

- Blend360 blazes a trail to client value but needs a formalized approach to innovation. Formed by ex-Merkle folks who saw the need for an analytics-focused provider, the name Blend360 refers to the company’s philosophy that clients derive the most value from blending their in-house talent with external specialists. To achieve this value, Blend’s vision for customer analytics combines pricing, promotion, and supply chain as well as marketing and CX — standard fare for the category. The provider takes an “it’s everyone’s job” approach to innovation, but without a dedicated team and budget, innovation is likely to lag. Given the company’s relative youth, it lacks the breadth and depth of partnerships many of its more established competitors boast. It was 100% US based a few years ago and is working on expanding its global delivery model to be more in line with category standards.

What Blend360 lacks in its own strategy, it makes up for in strategic consulting. The provider demonstrates the ability to unite disparate client functions on analytical goals and has even helped clients to adjust employee incentives to align with long-term goals like lifetime value rather than immediate metrics. Blend360 approaches MLOps in an ad hoc fashion, a gap for any advanced customer analytics vendor. The provider complies with mandatory privacy regulations but does not emphasize responsible AI practices such as fairness and explainability. Reference customers gave the vendor perfect marks on “likeliness to recommend.” Companies looking for strategic and measurement support or to align disparate business functions to drive long-term customer profitability should consider Blend360.

- Material majors in research and design, minors in customer analytics. Material’s vision, to “turn transactional moments into deep transformational relationships,” is bolstered by its focus on behavioral science and design. It does not have a formalized approach to innovation, relying on client engagement alone to germinate new capabilities, which is likely insufficient to remain competitive in this market. The provider also has a limited partner ecosystem, though Material recently hired a head of partnerships to build it. The vendor only employs about 60 data scientists, a mere fraction of the average among vendors in this space. It does, however, offer a formal training program to develop existing talent.

Material’s current offering exhibits gaps across the customer insights lifecycle. In terms of data management, the provider does not offer verticalized customer data models and has no proprietary customer data assets for enrichment. The provider takes a more market research-focused approach to customer analytics, starting with consumer segmentation and using it for acquisition, retention, and more. It does not possess strong capabilities in emerging analytical techniques such as reinforcement learning. Material does offer competitive insights delivery capabilities, using its expertise in design to embed insights directly and intuitively into employee workflows. Companies with limited analytics needs that are looking to create innovative customer experiences should consider Material.

Evaluation Overview

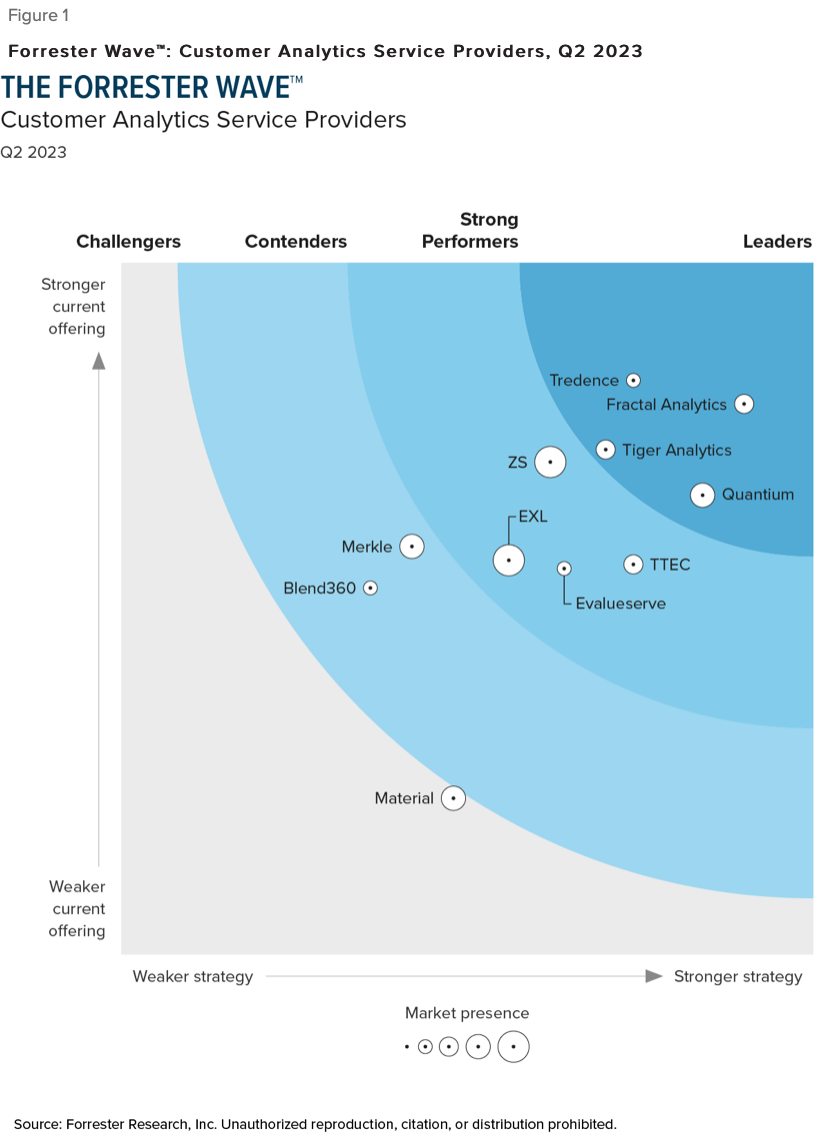

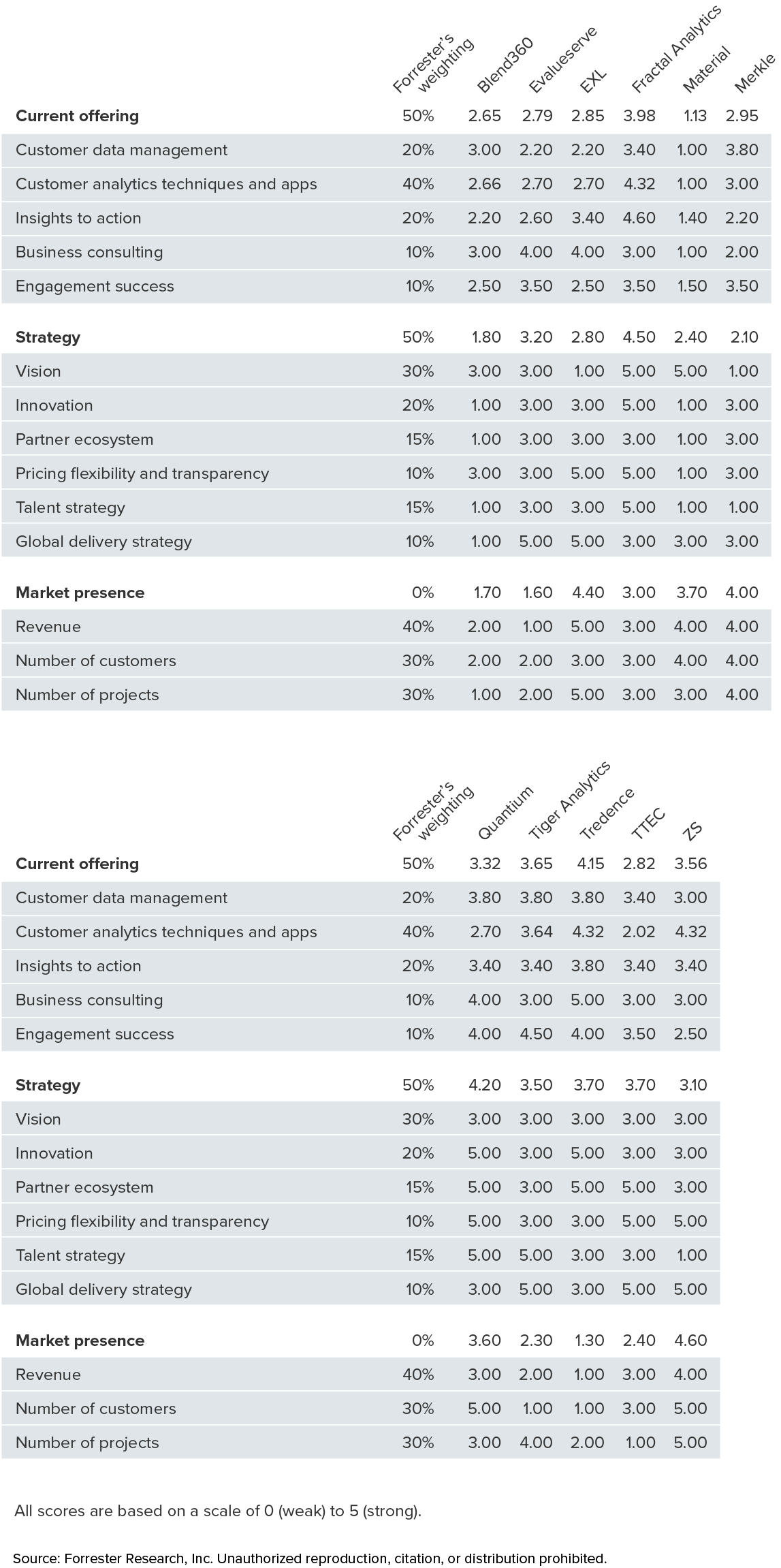

- Current offering. Each vendor’s position on the vertical axis of the Forrester Wave graphic indicates the strength of its current offering. Key criteria for these solutions include customer data management, customer analytics techniques and applications, insights to action, business consulting, and engagement success.

- Strategy. Placement on the horizontal axis indicates the strength of the vendors’ strategies. We evaluated vision, innovation, partner ecosystem, pricing flexibility and transparency, talent strategy, and global delivery strategy.

- Market presence. Represented by the size of the markers on the graphic, our market presence scores reflect each vendor’s revenue, number of customers, and number of projects.

- A customer analytics focus. We included only companies that specialize in customer analytics. These vendors primarily provide advanced customer analytics services, such as churn analysis, behavioral segmentation, and customer lifetime value analysis, to their clients.

- Revenue. Each of the companies we evaluated earned at least $40 million from customer analytics engagements in their last fiscal year.

- Vertical breadth. Each of the companies we evaluated provides customer analytics for clients in at least three verticals.

- Forrester mindshare. Each of the companies we evaluated has significant interest from Forrester clients.