5

GLO

GLO

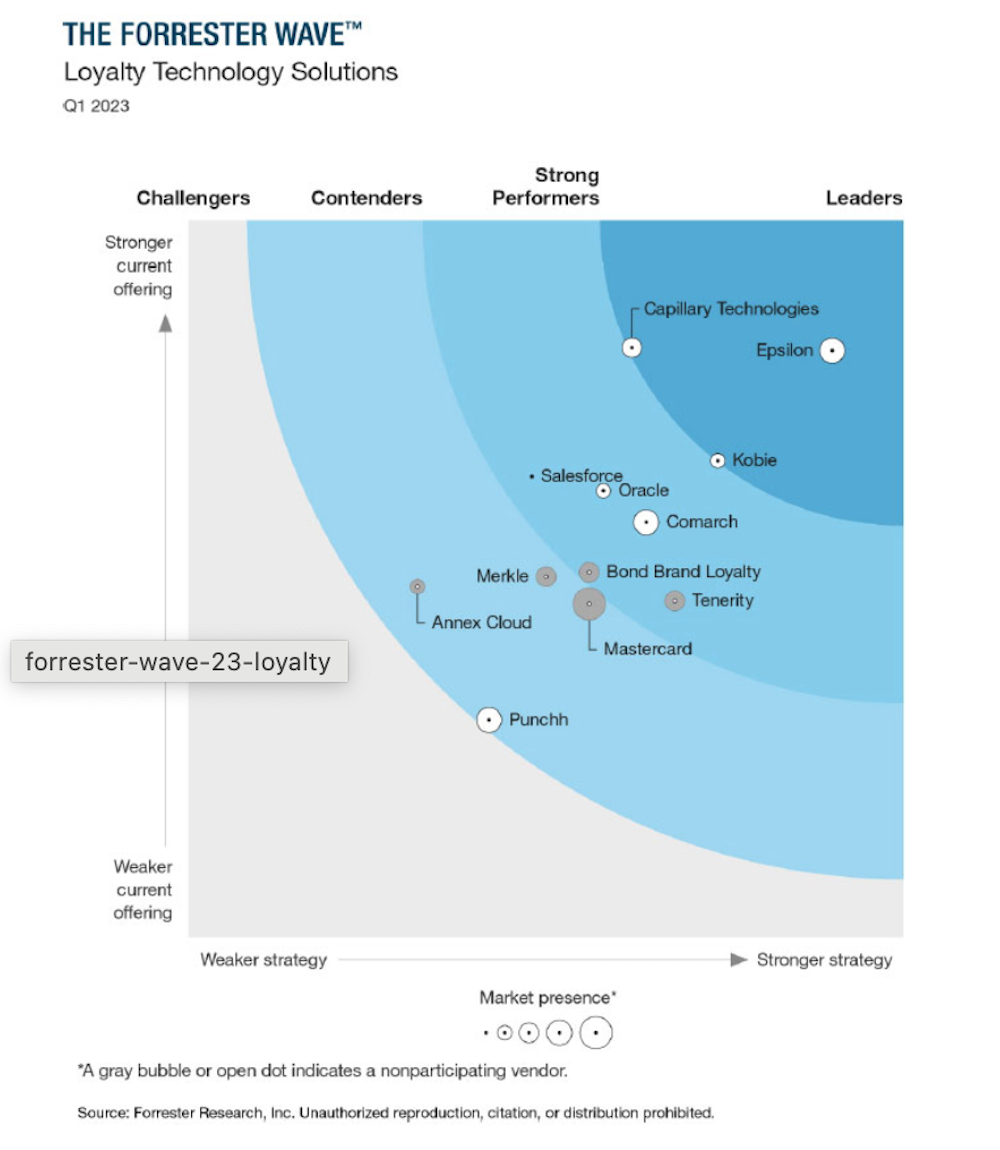

12 Loyalty Technology Solutions researched & scored: Annex Cloud, Bond Brand Loyalty, Capillary Technologies, Comarch, Epsilon, Kobie, Mastercard, Merkle, Oracle, Punchh, Salesforce, and Tenerity.

GLO

GLOIn 28-criterion evaluation of loyalty technology solution providers, 12 most significant ones are identified — Annex Cloud, Bond Brand Loyalty, Capillary Technologies, Comarch, Epsilon, Kobie, Mastercard, Merkle, Oracle, Punchh, Salesforce, and Tenerity — researched, analyzed, and scored. This report shows how each provider measures up and helps B2C marketing professionals select the right one for their needs.

The Forrester Wave™ evaluation highlights Leaders, Strong Performers, Contenders, and Challengers. It’s an assessment of the top vendors in the market; it doesn’t represent the entire vendor landscape. You’ll find more information about this market in our report The Loyalty Technology Solutions Landscape, Q4 2022.

Brands Need Profitable Loyalty Programs That Engage Customers

Brands continue to invest in loyalty programs and loyalty technology solutions to help them engage and retain consumers — who are cutting back on spending and looking for more deals in response to higher prices. According to Forrester’s Marketing Survey, 2023, 53% of B2C marketing decision-makers plan to increase their spend on loyalty technology in 2023, and economic uncertainty and scrutiny of marketing budgets has renewed marketers’ focus on the profitability of their loyalty strategies. Brands are concentrating on reducing the technology cost of ownership, improving customer lifetime value (CLV), and increasing incremental revenue. Loyalty technology solution vendors are adapting to these needs with flexible pricing models, modular platform configurations, and expanded partnerships to enable better analytics and more agile programs.

As a result of these trends, loyalty technology solution customers should look for providers that:

- Modularize their offerings. Increasingly, brands seek modular loyalty platforms to minimize overlap with the rest of their marketing technology (martech) ecosystem. Overbuying not only increases tech and support costs; it also results in redundant capabilities — such as campaign, promotion, or profile management — that increase the risk of delivering inconsistent customer experiences or negatively impact promotional spend. Overall CX quality declined in the US in 2022, and brands need a rationalized martech ecosystem to help them improve the experiences they deliver.

- Excel in loyalty program management. Setting up and managing a differentiated loyalty program requires flexible functionality to support tiers, currencies, rewards, referrals, and fraud management — capabilities that are unique to loyalty technology solutions. And to stay relevant to consumers’ changing needs, brands must periodically review and update their loyalty program value proposition. Look for vendors that offer agile program management; are regularly adding new rewards options; and use AI/ML to predict, identify, and take automated action on potential fraud.

- Provide a robust partner ecosystem with seamless integrations. The provider ecosystem to support loyalty strategy, execution, and optimization is vast — beyond loyalty services agencies, there are specialists in gamification, advocacy, engagement, insights and analytics, social communities, personalization, zero-party data collection, promotions and offer management, and more. Loyalty technology solutions providers don’t need to enable all these capabilities natively; using partners can be more efficient. Look for vendors that offer packaged and full-featured integrations with their partners and are transparent about how capabilities are delivered and priced: The platform pricing should reflect whether the specific capability is part of the package you are buying, or an add-on.

- Demonstrate a clear and future fit vision with an aligned roadmap. Loyalty technology solutions are a long-term investment — 50% of the reference customers in this research have used their loyalty technology solution provider for a minimum of four years, and 30% have relationships lasting eight or more years. Leading vendors monitor and act on market trends by enabling new features, functions, and rewards; ensure their platforms are future fit; and listen to their clients when planning improvements. Look for vendors with a strong track record of delivering on planned enhancements and that include specific delivery dates for future enhancements in their roadmap.