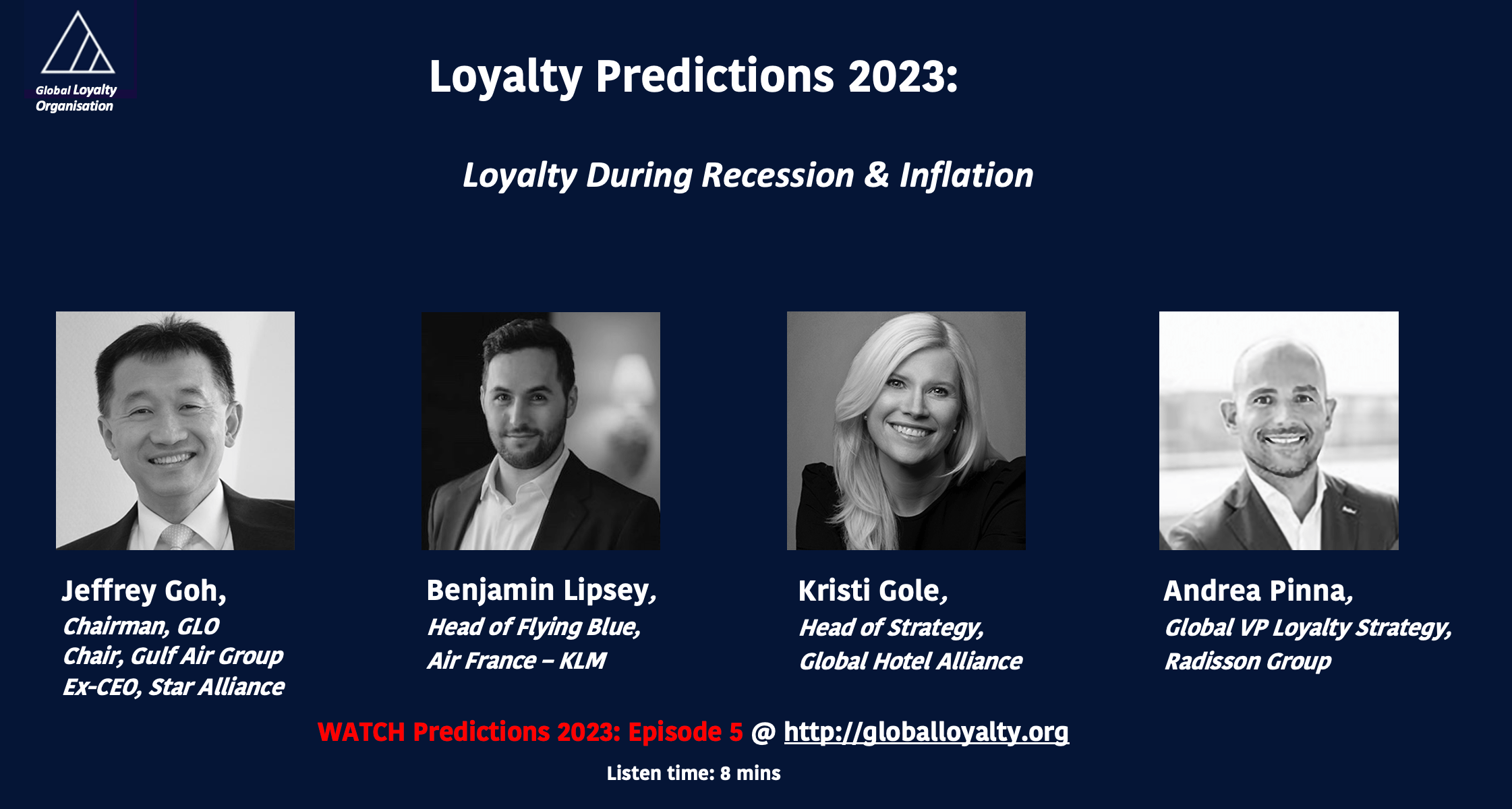

Featuring: Jeffrey Goh, CEO Gulf Air Group // Benjamin Lipsey, Head of Flying Blue Air France - KLM // Kristi Gole, Head of Strategy, Global Hotel Alliance // Andrea Pinna, Global SVP Loyalty Strategy, Radisson Hotel Group.

GLO

GLO

Jeffrey Goh, CEO of Gulf Air Group, ex-CEO Star Alliance: I think the challenge of price inflation, as general challenges go, presents also opportunities. In the broader context, this is an opportunity for the loyalty world to disrupt itself and reinvent various dimensions of the loyalty proposition. As prices inflate, customers and consumers are going to look for added value. The question then becomes, ‘What can the loyalty proposition offer as additional value to these consumers and to these customers? There are multiple ways, I think, that we can deliver that. It is a great opportunity for loyalty programmes to see how customers can be reengaged in a slightly different way. As a great believer in the loyalty ecosystem, where it is perhaps a challenge for one loyalty programme to continue as a standalone program. But the power of partnering with other loyalty propositions or loyalty programmes can bring added value to consumers and to customers. Hence, as much as I think it is a challenge in terms of price inflation, it is also an opportunity for us to reinvent the different aspects of our local propositions.

Ben Lipsey, Head of Flying Blue, Air France – KLM: I think it’s important to both retain existing customers and go after new ones. Consumer behaviours vary significantly in different cultures. In Japan, for example, customers will rarely complain, they’ll just take their business elsewhere. You won’t really realise the customer was upset you only see their share of wallet drop.

I think, there’s a lot of money to be made in keeping your existing customers happy and spending more by making them feel valued and rewarded and making them feel that the loyalty programme serves a benefit to them so that they will continue to engage with you. And at the same time, we have to be wary of the fact that customers are changing as the consumer demographics have changed. We have to find ways to remain relevant to new customers who are not just travelling for business. You have leisure which is an exploding demographic as well, you have the Millennials and Gen Z who are much more focused on sustainability, in Europe in particular. So how do we appeal to them? We’ve had millennial customers come and tell us, ‘I’m a platinum customer. I like the benefits. I like the programme. I feel rewarded, but I don’t want to be recognised as a platinum customer when I’m travelling with friends or family because I’m embarrassed. It means I travel a lot and I’m embarrassed about my carbon footprint.’ So for us, that’s a typical problem to solve. How do we remain relevant? How do we continue to attract this customer and keep this customer happy when they don’t want you to recognise them the same way? Whereas historically that was always what they wanted. They wanted more recognition. Customer demands are changing. If we are not able to predict, respond to, and cater to those new and changing demands, we are going to be at a loss. Going forward, it’s really important to both keep existing customers happy as well as find new ways to engage new customers who might be less brand loyal. And that’s what studies are showing us.

Kristi Gole, Head of Startegy, Global Hotel Alliance: All audiences are affected by inflation or economic turmoil but in different ways. I think consumers will be more deliberate with their purchases. They’re still going to travel; I think they need that after several years of being restricted they went all-in in 2022. I think 2023 will be the same. People are wanting to see more and experience more and get out. So, if anything, they’re going to maybe have higher expectations of a true experience when they do spend their money. In my opinion, I don’t think they’re going to not take the trip and they are going to stay in a luxury hotel if they choose to. And I think they’re still going to spend that money, but they’re going to expect you to deliver on the experience. They’re going to make sure that you are fulfilling their expectations, that they’ll be treated well, that they’ll see exciting things, and that they’ll have experiences that will give them memories and something different than their day-to-day. I think that this is going to benefit the luxury segment.

In terms of discounts, that’s always been the number one – and we did some research recently and that was the number one that customers are looking at from loyalty programmes. So tying that to the financial aspect: loyalty programmes give you a discounted rate. So right there is a reason to join even if you weren’t going to. Then loyalty is a reason to make sure you have the best value for what you’re going to purchase, whatever it is, make sure you get that member rate. And then if you’re part of the CRM, if you’re part of the email list then you could also be getting a 40% exclusive offer. And all those different sales happen very often if you are a loyalty member. So again, it goes back to that we’re in a good space where if people are price sensitive, or if they are looking for better value so that they can make their dollar stretch further, loyalty is a good excuse to get them in and say we’re going to help them get there.

Andrea Pinna, Global VP Loyalty Strategy, Radisson Hotels: At Radisson Hotel Group we are proactively working to ensure the continued profitability for our hotel owners in this current environment. We are working in partnership with our suppliers on ways to mitigate the cost increase in the supply chain including optimising labour costs, adapting new innovations, focusing on cost optimisation, digitalisation and localising the supply chain to minimise the imports and foreign exchange fluctuations, especially with the current macroeconomic and political scenario. Redefining our internal operational SOP is something very important to adapt for the hotel delivery requirements.