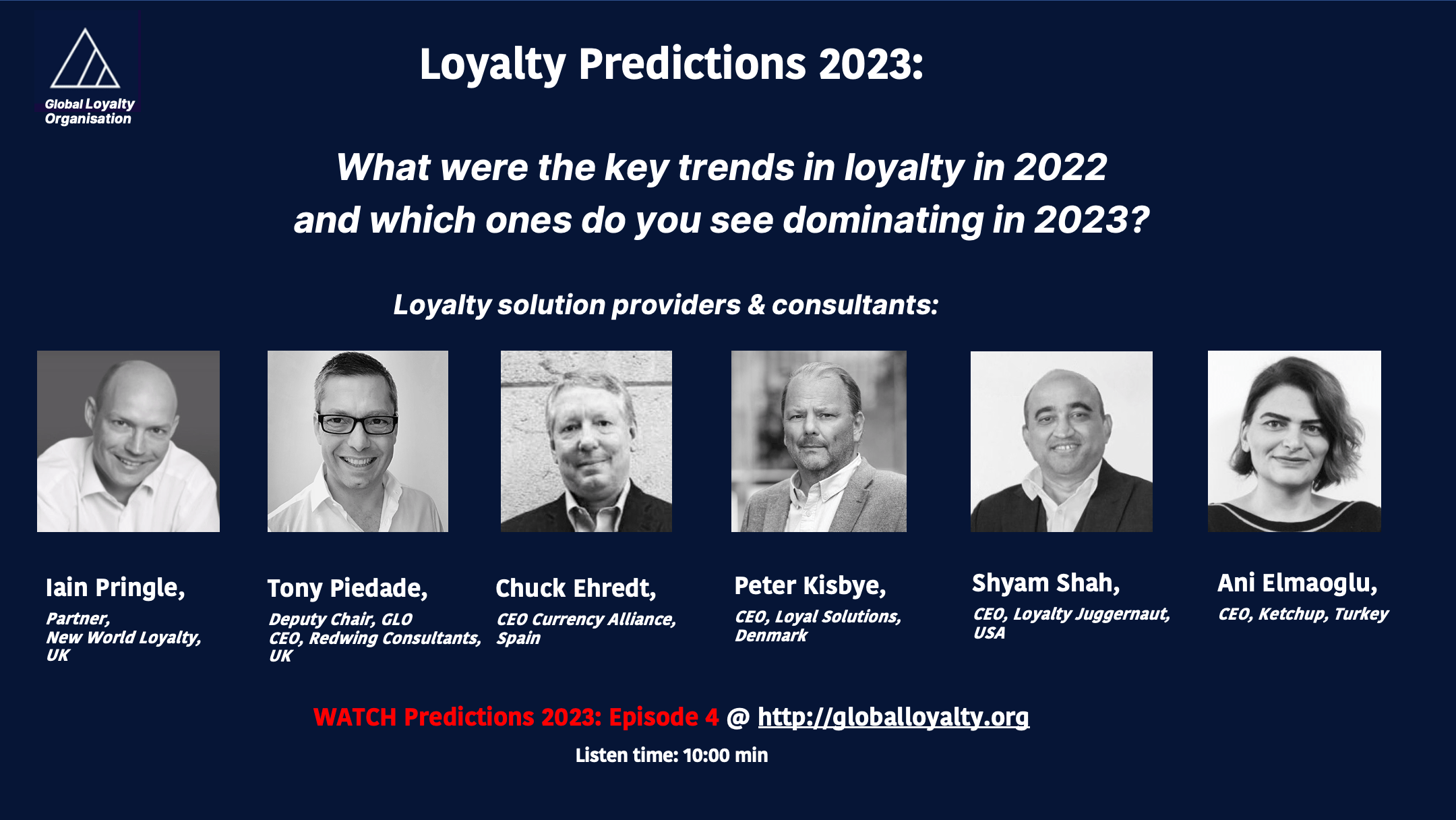

Video Interview featuring loyalty experts: Shyam Shah, CEO, Loyalty Juggernaut, USA/ Peter Kisbye, CEO, Loyal Solutions, Denmark / Chuck Ehredt, CEO Currency Alliance, Spain / Ani Elmaoglu, CEO, Ketchup, Turkey / Tony Piedade, Deputy Chair, GLO / CEO, Redwing Consultants, UK / Iain Pringle, Partner, New World Loyalty, UK

GLO

GLOIain Pringle, Partner, New World Loyalty (UK):

As a consultant, we generally tend to do one of three things. We generally tend to help customers launch programmes if they don’t have a programme. We help fix programmes that are somehow broken or not working effectively. And a third of our work is doing general engagement with customers that’s not necessarily associated with loyalty. Every company has to engage with their customers and loyalty is just a method of doing that. And in fact, in the last three years, I’ve had at least three clients where we’ve proposed not having a loyalty strategy or not having a loyalty programme because they could get the benefits of loyalty without doing that. Out of those three, the one I’m seeing most of at the moment is the second one, which is programmes, which aren’t working effectively. Having looked at probably hundreds of loyalty programmes in my career, I would say that at least half of them don’t work as well as they should. The question is are they actually making money on a return-on-investment basis? I would say about half of them aren’t. For the last 12 months, we’ve been very much helping customers to look at how they can make their existing strategies profitable and more effective. And I think that’s definitely going to be the main trend for 2023 because with the cost pressures everyone is facing if you’re giving away anything to customers it has to be effective.

Value and ease are going to be under question in 2023. The questions are: is your process easy enough and do you give enough value to reflect the process for people to come in? Because people want programmes to be easy and valuable. All the other stuff, gamification, emotional response, personalisation, mobile experiences, all that you can put on top of a programme that’s working. If the programme isn’t fundamentally working, and you’re not providing a simple enough and valuable enough solution, then you need to address this first. The one trend I would pick is mobile experiences. How can you move away from plastic cards and more into the mobile wallet? Not an app but how can you make that mobile experience easier? And I think they are the ones which are going to dominate in 2023. How can we move away from the fact of having your own app for a small number of very engaged customers to saying how can I move to integrate more into the mobile wallets where you’re going to have more customers interacting more often and how can I compete in that space rather than own space?

Tony Piedade, CEO Redwings Consultants (UK):

Being an independent loyalty consultant I see it all, a whole range of businesses that are either in transport or retail, hotels, entertainment and so on. The key thing that I find throughout is that everybody is trying to establish the true fact about their loyalty program, what kind of health is it in at the moment? Are they getting the maximum value for that program right now? The other thing is around reward. I do think that any loyalty program that is too entrenched in just the points element, what we call the “do this – and get that” story, I think they are going to be weaker, and we are transitioning to a world where everybody’s got a loyalty programme and as consumers, we are demanding more. So how can I through the loyalty programme unlock experiences, unlock a more one-to-one dialogue with the brand that I wouldn’t otherwise get as a one-off trader or shopper with you as a business or brand. So I think we’re going to see a lot more of these experiential rewards coming through. I think we’re also going to see perhaps a return to the loyalty saver and hence the concept that actually you’re not looking for such quick redemptions, but you’re willing to save for something which is greater and has a greater value. I think that’s really going to be driven by the brand’s appetite to build and produce a redemption product worth saving for. The airlines do this well, they know that the redemption on a first-class flight or a business-class flight to your favourite destination is so appealing, that people will spend longer collecting miles to achieve that. So, I think we’re going to see some of that transpose more into a retail environment where upfront the brands will start to tell consumers about what they can earn if they stay loyal, save more and engage with a loyalty programme. Now I’m quite excited by that because that really opens up some creativity in a lot of these brands that go way beyond just a “one point for one pound spend” type conversation.

I think the main one and the one that really has come into its own and because of a number of players now in this market – is card linking. The fact that loyalty is done for you. All you just do this little thing of linking of loyalty and payments together and suddenly your rewards appear effortless, and you don’t have to remember to put in your loyalty card number or you don’t have to remember to log in somewhere. I think that’s going to stay and that the banks are playing a really important role in making it so much easier.

I think personalisation is a given and is always going to be around. Loyalty is not an excuse for you to not be personal with your customers. It gives you the ability to be even more personal. In fact, a lot of people would say “I’ve given you all my data, why are you sending me stuff that is completely irrelevant to me?” Such conversations are still going on today.

I’m really interested in gamification, and I’ve had a number of clients and conversations in e-Sports area and computer gaming. But I’ve not yet found a really good way of introducing gamification to loyalty without overstepping that boundary of betting where conceptually you’re putting something at risk in order to earn something else. I think there are some opportunities and industries out there where this would be really cool. For example, gyms in terms of active participation and number of visits, as it’s good for my health and currency can play positive role in that space. Or whether it’s something that tracks steps if I’m not in a gym or something that tracks walking. Vitality is doing some initiatives in this space, which I think is exciting. Gamification from a goal setting perspective could be quite interesting. I just don’t think it’s very appropriate for a lot of other brands out there and I’ve not found the one that’s doing it well yet.

Chuck Ehredt, CEO Currency Alliance (Spain):

We do think there’s been an evolution in how brands are trying to engage with customers and so gamification has become more interesting because it does drive engagement with customers. Card-linking is also an important technology in many parts of the world, where one payment network is quite dominant, which might be Visa or MasterCard or American Express because the customer experience at retail is superior because the customer doesn’t have to identify themselves at the point of sale if they’re using card linking as a mechanism to identify the customer transaction with a partner.

And so, brands are at different stages of implementing each of those different types of customer engagement techniques. And depending on where the brand was at the beginning of 2022, and where it ended up by the end of 2022, will dictate where they start in 2023. But again, I think all of those techniques are the major trends that are the priorities for the larger loyalty programmes. And so they’ll all continue to be important, but on a brand-by-brand basis, it depends on where they are today, and what they’ll focus on during the next three, six or 12 months.

Peter Kisbye, CEO Loyal Solutions (Denmark):

I see the programmes that are relevant for the member dominating. And that’s, of course, really hard to quantify. But the programmes where they are able to be relevant, will be the winners and I would say regardless of technology, then it can be better or worse, based on the technology. I think that’s one definite that will prevail. I also think that programmes that offer an earn-and-burn capability across either within their own assets, if they have enough assets to be relevant and have enough frequency of use, then they can do it in their own environment. That could be like a very large hotel chain, for example, or a large supermarket chain. But everybody else who doesn’t have daily interactions with the consumer needs to build partnerships to make their loyalty programmes work. In the old days, it was always about coalition programmes which had a lot of issues. The ones I see winning are the ones with a strong owner of the programme with a lot of partners but there is an owner. So, an example would be Scandinavian Airlines. They have a strong programme where they have over 2000 different partners, but it’s still a Scandinavian Airlines proposition controlled by Scandinavian Airlines. But because a lot of people don’t fly very much the infrequent fliers need other activities to engage with the programme. I see those programmes winning in the short and long term.

Shyam Shah, CEO Loyalty Juggernaut (USA):

In 2022, I think one of the major key trends we noticed that was very universally acknowledged and accepted was the need for the programmes to go beyond transactionality. I think it was a widespread acknowledgement that the programmes ought to be personalised and that one size fits all is no more acceptable to the digital customers of the modern era, I believe, would be the topmost trend we saw in 2022.

The rise of partnerships, I think, is also a notable trend. We’ve actually seen several loyalty programmes exploring the idea of morphing themselves into lifestyle-oriented rewards programmes. Even though it’s in the nascent stages, we expect that trend to continue to strengthen further in 2023 and thereafter, we do believe that the ecosystem is the future of loyalty programmes.

We also saw in 2022, broader use of artificial intelligence and machine learning technologies. I think we found several compelling use cases that started to leverage AI very effectively. Until 2022, there were lots of experiments done, but in 2022 where we started to see that AI is starting to deliver value in terms of driving customer experiences, in terms of fraud detection, in terms of forecasting, and anomaly detection. AI has started to play a wonderful role in loyalty management. And we just see the penetration of AI continue to increase as we go into 2023.

Ani Emanoglu, Ketchup Loyalty (Turkey):

Personalization and mobile experiences were keys for us in 2022. In 2023, programmes will move closer to the buying process and be focused on commercial KPIs. In this sense, predictive analytics and segmentation will gain importance and this will support hyper-personalisation that we see as the main key trend dominating in 2023.