Digital payments and digital wallets go hand-in-hand with loyalty. Juniper explores current state of the payment card market, ranks its leaders and challengers. The number of payment cards issued via digital platforms will reach 1.3 billion annually by 2027, up from just 500mn in 2023. growth of 170% reflects strong interest in improving the way users access and replace cards from issuers. Close to 40% of the payment cards in 2027 will be in China and Far East Asia.

GLO

GLOJuniper Research Whitepaper: MODERN ISSUING ~ INNOVATION FOR PAYMENT CARDS

Digital payments and digital wallets go hand-in-hand with loyalty. In this whitepaper and corresponding research Juniper explores current state of the payment card market, ranks its leaders and covers latest innovation trends.

Key takeaways:

-

Regardless of their evolution and popularity, payment cards now stand at a crossroad, and increasingly face competition from purely digital platforms.

-

Consequently, card issuers are increasingly turning to modern card issuing platforms, leveraging their capabilities to offer a digital-first card proposition to their customers. In doing so, issuers can instantly push virtual cards to digital wallets, with the option to follow on with a physical card.

- From the issuers’ perspective, having the ability to offer a virtual, as well as a physical card, fosters customer engagement and usage in different verticals (ie, physical outlets, online shops), and reinforces brand loyalty.

-

From the customers’ perspective, digital cards and card issuance can be viewed as a more secure and environmentally friendly alternative to traditional cards and the issuance process.

-

Juniper Research anticipates that by 2027, the number of credit cards issued via modern card issuing platforms is set to rise to over 311 million globally. This is especially important in the emerging markets’ context, where mobile wallet usage is a dominant payment medium and therefore, digital issuance can contribute to cashless societies while enabling better and fairer accessibility to financial products.

-

The card issuing market has historically depended on major manufacturers, which offered integration of the latest payment and security technologies in produced cards, such as the EMV (Europay, Mastercard, Visa) chip, as well as cards manufactured from various materials (ie, plastic, metal).

-

Banks/FIs are now facing increased pressure to digitise their card offerings in competition with neobanks and other digitally native challengers.

-

Intensified competition for cards has been extending into the card issuance platform space for the past few years, with vendors from different segments of the market launching similar propositions.

-

In the card manufacturer space, competition has been growing to highlight differentiation (ie, support for different types of cards, personalisation and marketing add-ons, and push provisioning speed and security). The challenge for these manufacturers will be to develop and/or attain capabilities through further acquisitions to challenge fintech vendors.

- In the payment service providers space, vendors aim to emphasise the ecosystem approach through which a single platform can answer multiple financial needs of businesses, with digital cards acting as a gateway for embedded finance services. One prominent constraint for these vendors has been the limited number of eCommerce vendors and marketplaces that reach a certain business scale and volume to offer digital cards to end users.

Forecast

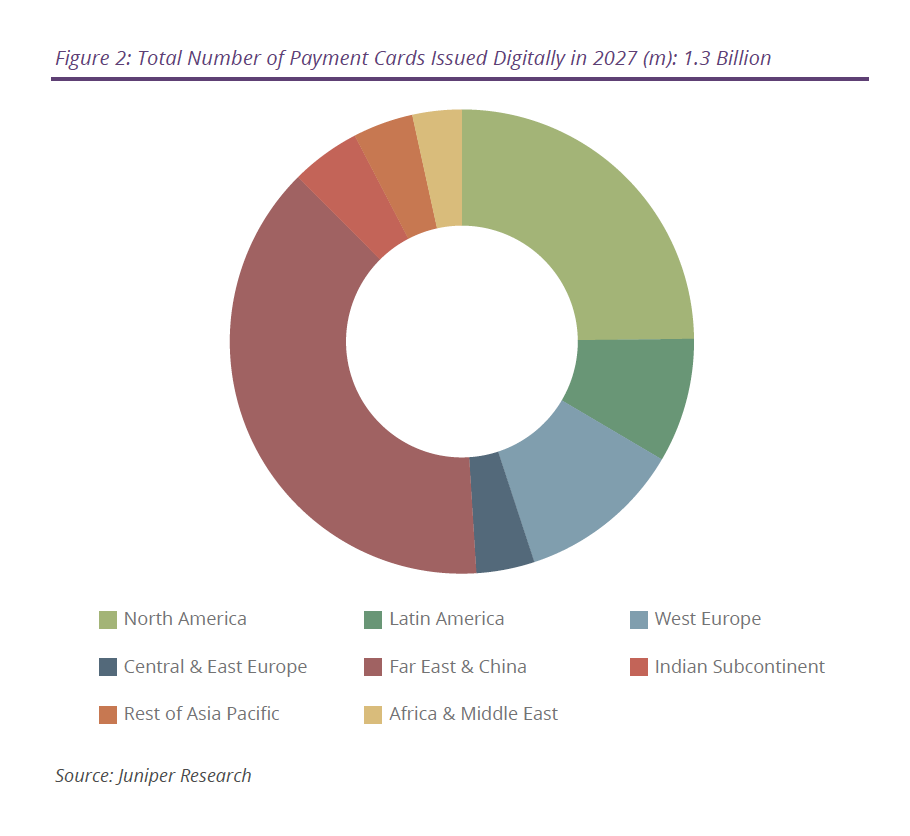

- The number of payment cards issued via digital platforms will reach 1.3 billion annually by 2027, up from just 500 million in 2023. This growth of 170% reflects strong interest in improving the way users access and replace cards from issuers. This is in the context of strong competition to issuers from digital-only banks and new fintechs offering card services.

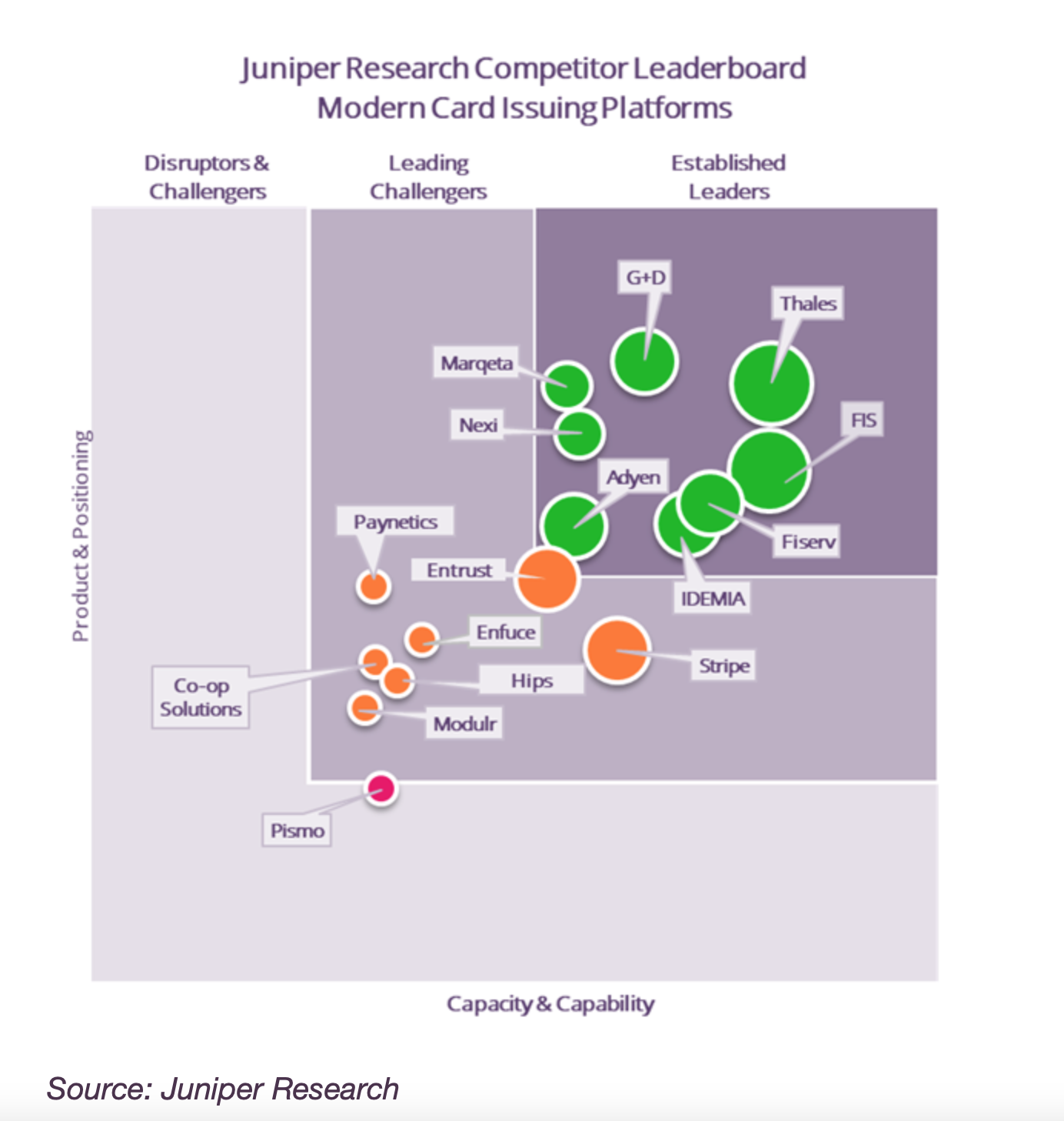

- Juniper Research released its latest Competitor Leaderboard for 2023. Underpinned by a robust scoring methodology, the new Competitor Leaderboard ranked the top 16 leading modern card issuing platforms, using criteria such as the completeness of their solutions and their future business prospects.

- The top 5 vendors for 2023:

1. Thales

2. G+D

3. FIS

4. Fiserv

5. Marqeta

- The leading players scored well based on their breadth of customisation options and the large number of customers and capabilities, such as personalisation and tracking available. In order to stay ahead of the competition, modern card issuing platform vendors must develop solutions that are easy to adopt and deploy, ensuring that these features can integrate with existing bank IT systems and bypass them where necessary.

- Far East Asia & China to account for close to 40% of the total number of payment cards to be issued digitally in 2027.

- For issuers, staying relevant in an increasingly tech-enabled banking market is challenging. Improving the flexibility, transparency and personalisation of the card issuing process is an important way in which issuers can enhance the user experience. As such, issuers should look to design superior user experiences, leveraging the capabilities that digital card issuing platforms can provide.