Despite challenges like fluctuating exchange rates, climate issues, and varying affordability, the desire to travel remains strong. People are becoming more strategic about their travel choices, leading to significant shifts in travel patterns in 2024.

Mastercard

MastercardIn 2024, the travel sector has been breaking boundaries. Through March 2024, consumer spending on travel remains strong, and passenger traffic has soared. Mastercard Economics Institute anticipates this momentum will continue as consumers prioritize meaningful experiences and allocate more of their budgets to travel. More than ever, consumers are empowered by a strong labor market to embrace experiences with travel at the top of the list.

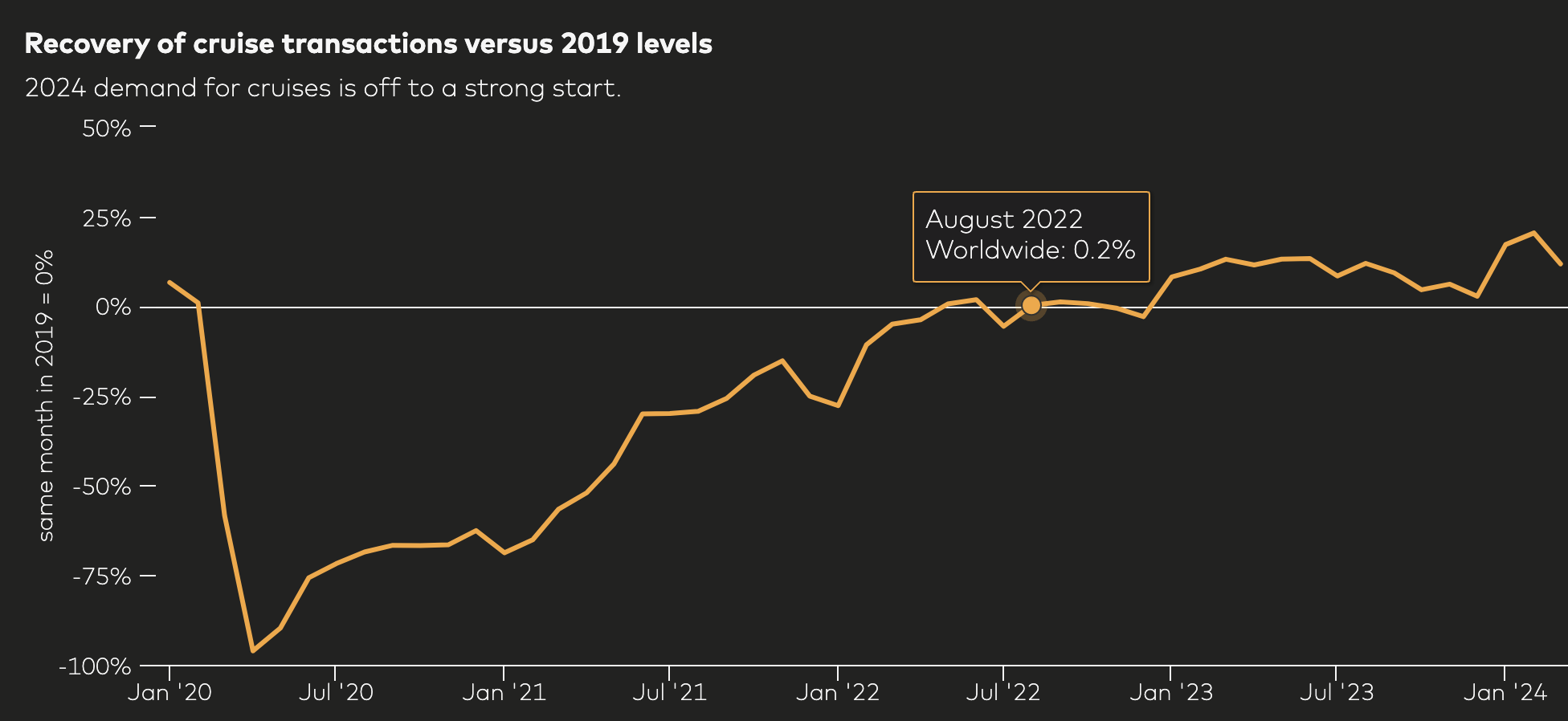

We found that travelers are extending their trips by an extra day over the 12 months ending March 2024 compared to the same period in 2019, highlighting a growing desire for more immersive and meaningful travel experiences. In addition to air travel, vacationing by cruise has experienced extraordinary growth, surpassing 2019 records.

Despite challenges like fluctuating exchange rates, climate concerns and varying levels of affordability, the desire to travel remains strong. People are becoming more strategic about how, when, and where they travel, with 2024 seeing significant shifts in travel patterns.

In the Mastercard Economics Institute’s fifth annual travel report, “Travel Trends 2024: Breaking Boundaries,” we explore these evolving trends and the state of travel in 2024 and beyond.

Top Themes in Travel

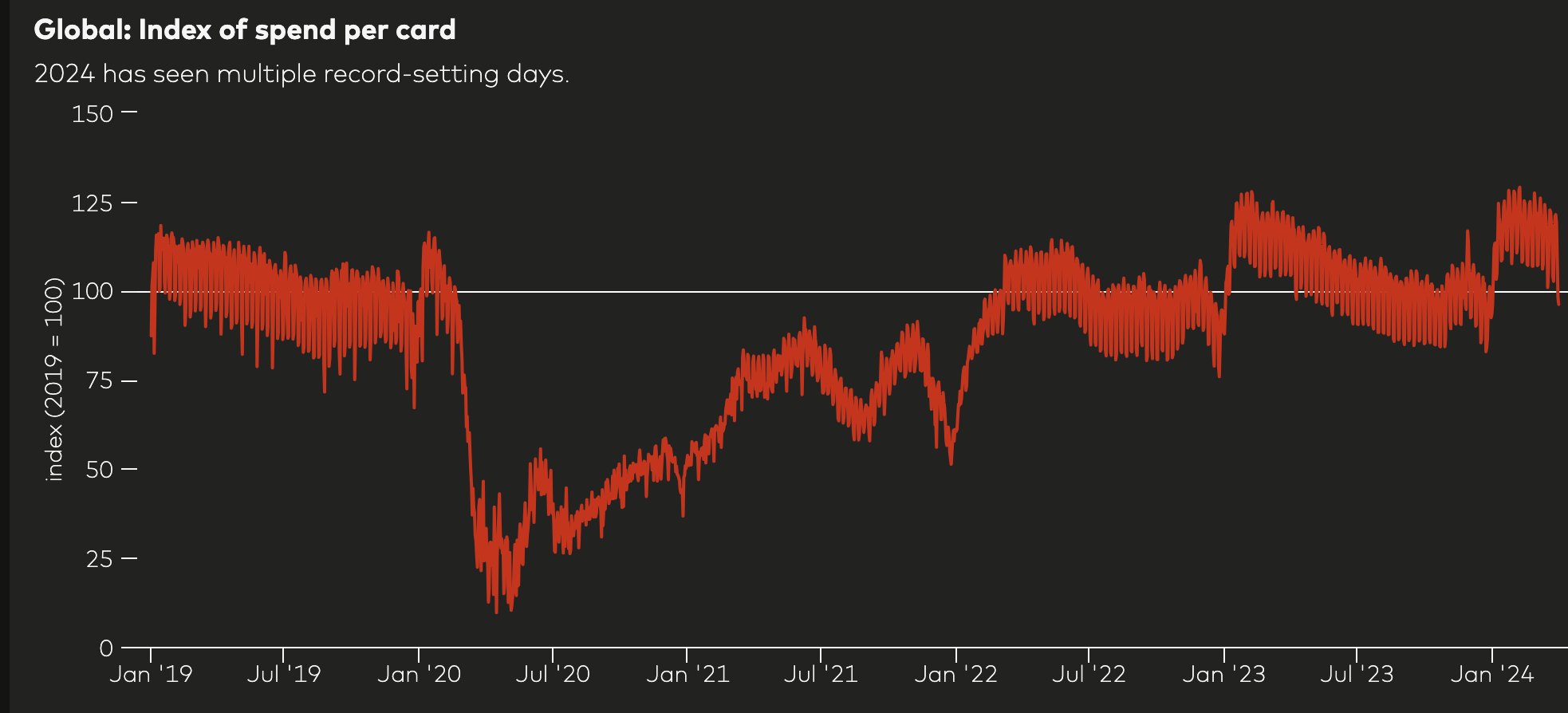

Globally, nine out of the last 10 all-time record spending days in both cruise and airlines have happened in 2024. 1

2024 has kicked off with strong growth in the travel industry – in terms of spending but also the number of people traveling. The year started with strong momentum, and the Mastercard Economics Institute expects it to continue:

Some noteworthy examples of this strength in 2024:

- Passengers traveling: An all-time high of about 15.9 million Americans traveled internationally in Q1 2024 while Japan welcomed over 3 million passenger arrivals in March 2024 2

- Consumer spending: As of March 2024, nine out of the last 10 record-setting spending days in the global cruise and airline industry were in 2024 3

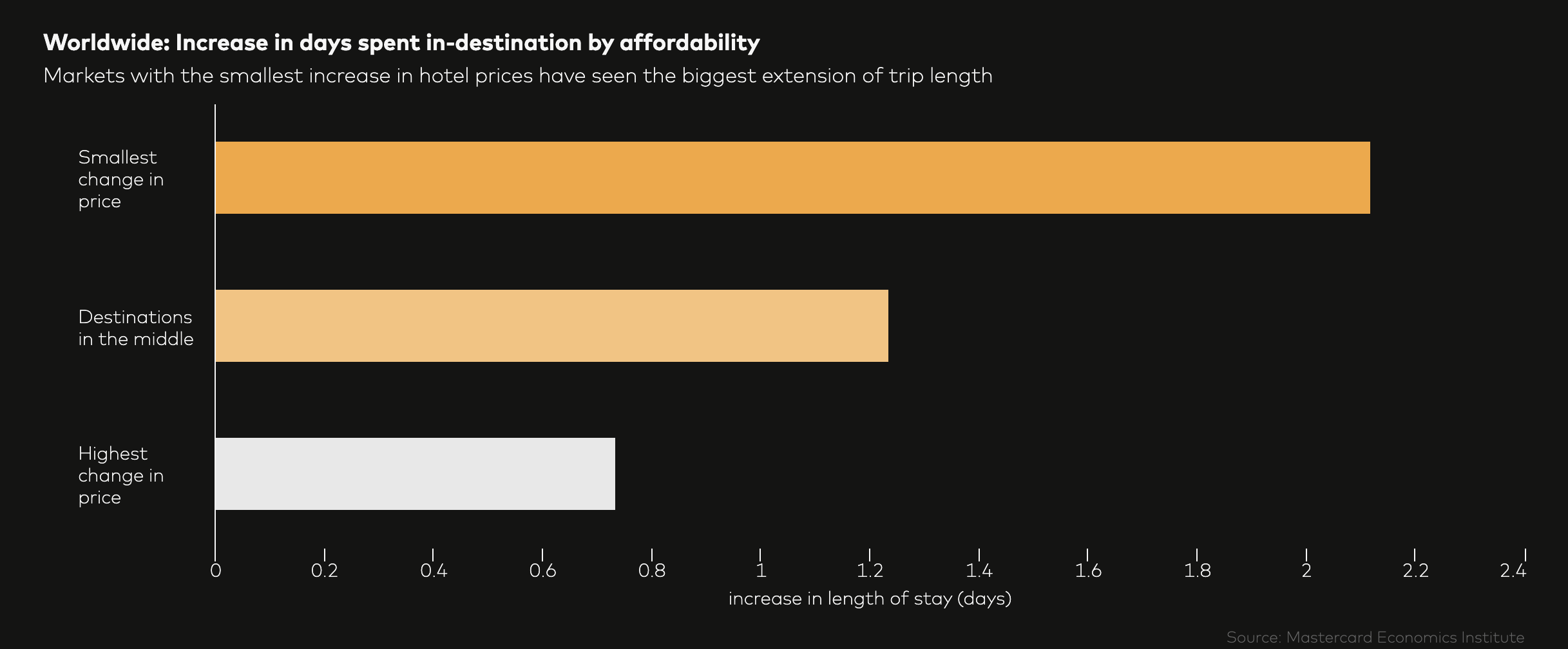

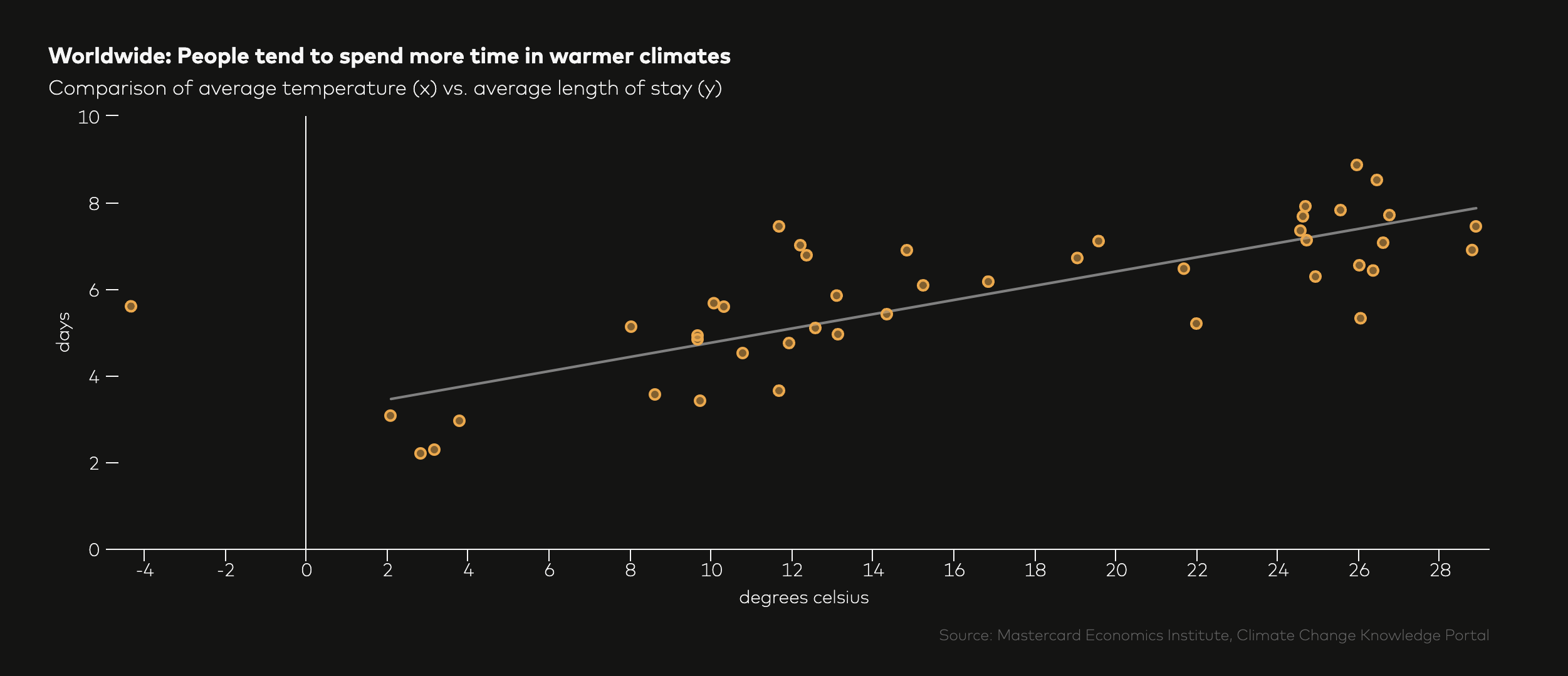

- Leisure for longer: Tourists spend more time on vacation, by about one extra day relative to pre-COVID trends, particularly for lower-cost destinations

- Traveling for events: Memorable events are driving travel trends, whether it is for concerts or sporting events – look out for a rush of travelers to Munich for the opening game of the European Championship

- Top gainers: Japan, Ireland and Romania experienced the strongest growth in share of spending from tourists relative to last year

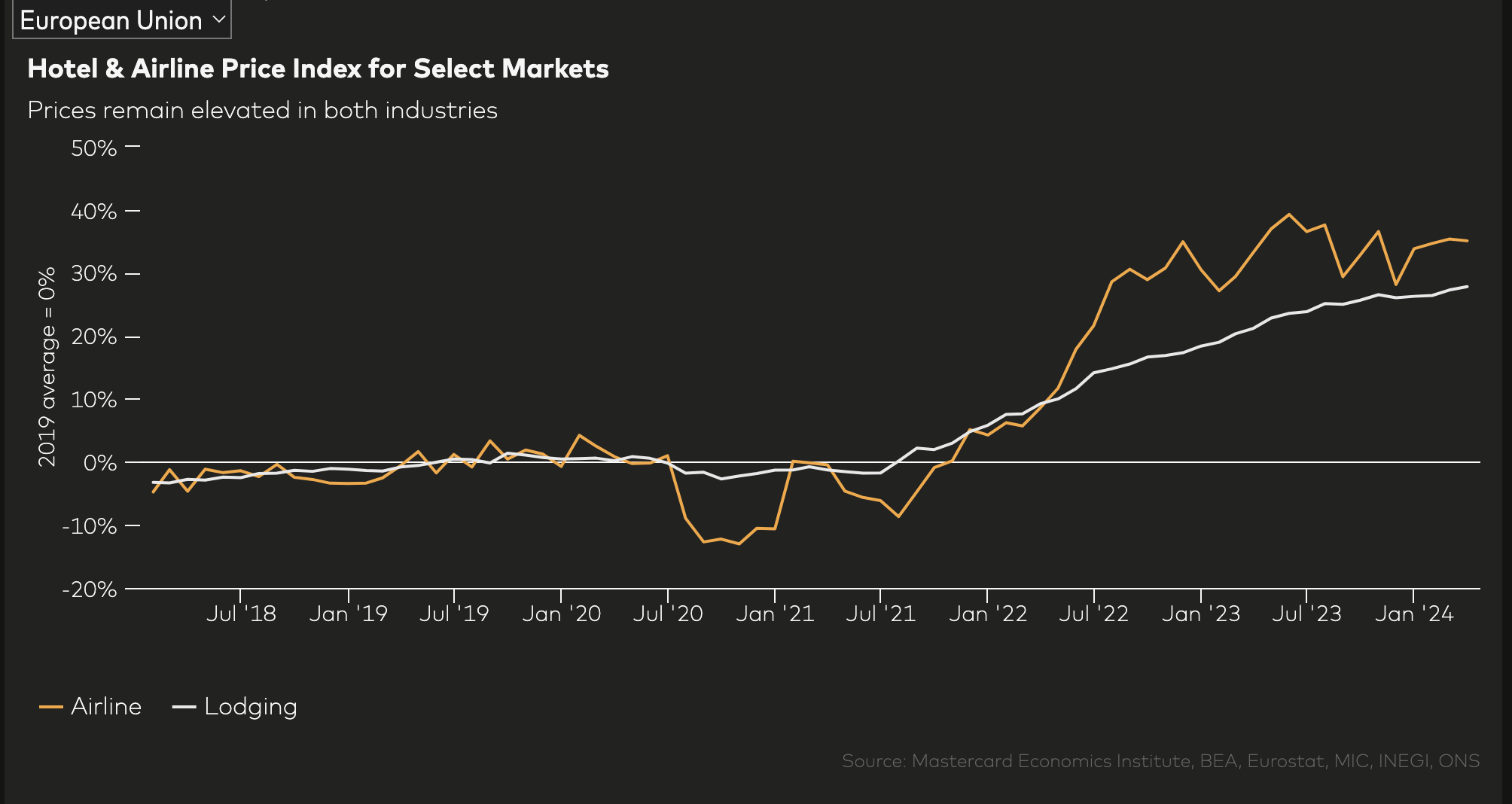

Analyzing aggregated & anonymized Mastercard transaction data, we find that records are being broken in the travel economy, as illustrated by the chart below. We can thank the solid economic backdrop – the healthy labor market around the world is allowing consumers to spend more on travel.

Leisure for Longer

Worldwide, travelers are extending their trips by about a day on average.

We found that tourists are spending more time on vacation – about one extra day relative to what was normal pre-COVID. Longer stays in destinations generally translate to longer spend per trip, too, which benefits local businesses.

The Middle East and Africa (MEA) region and Europe have been benefitting the most from this trend, both with roughly two extra days spent while in destination. Conversely, the United States has benefitted less from this new trend, having seen a smaller increase in extended trip lengths. 4

In the last section of this report, we dive deeper into why this has been happening.

Disclaimer: Press release

© Press Release 2025

Send us your press releases to news@globalloyalty.org

Press releases originate from external third-party providers. This website does not have responsibility or control over its content, which is presented as is, without any alterations. Neither this website nor its affiliates guarantee the accuracy of the views or opinions expressed in the press release.

The press release is intended solely for informational purposes and does not offer tax, legal, or investment advice, nor does it express any opinion regarding the suitability, value, or profitability of specific securities, portfolios, or investment strategies. Neither this website nor its affiliates are liable for any errors or inaccuracies in the content, nor for any actions taken based on it. By using the information provided in this article, you agree to do so at your own risk.

To the maximum extent permitted by applicable law, this website, its parent company, subsidiaries, affiliates, shareholders, directors, officers, employees, agents, advertisers, content providers, and licensors shall not be liable to you for any direct, indirect, consequential, special, incidental, punitive, or exemplary damages, including but not limited to lost profits, savings, and revenues, whether in negligence, tort, contract, or any other theory of liability, even if the possibility of such damages was known or foreseeable.

The images used in press releases and articles provided by 3rd party sources belong to the respective source provider and are used for illustrative purposes in accordance with the original press releases and publications.

Disclaimer: Content

While we strive to maintain accurate and up-to-date content, Global Loyalty Organisation Ltd. makes no representations or warranties of any kind, express or implied, about the correctness accuracy, completeness, adequacy, or reliability of the information or the results derived from its use, not that the content will meet your requirements or expectations. The content is provided “as is” and “as available”. You agree that your use of the content is at your own risk. Global Loyalty Organisation Ltd. disclaims all warranties related to the content, including implied warranties of merchantability, fitness for a particular purpose, non-infringement, and title, and is not liable for a particular purpose, non-infringement, and title, and is not liable for any interruptions. Some jurisdictions do not allow the exclusion of certain warranties, so these jurisdictions may not apply to you. Global Loyalty Organisation Ltd. Reserves the right to modify, interrupt, or discontinue the content without notice and is not liable for doing so.

Global Loyalty Organisation Ltd. shall not be liable for any damages, including special, indirect, consequential, or incidental damages, or damages for lost profits, revenue, or use, arising out of or related to the content, whether in contract, negligence, tort, statute, equity, law, or otherwise, even if advised of such damages. Some jurisdictions do not allow limitations on liability for incidental or consequential damages, so this limitation may not apply to you. These disclaimers and limitations apply to Global Loyalty Organisation Ltd. and its parent, affiliates, related companies, contractors, sponsors, and their respective directors, officers, members, employees, agents, content providers, licensors, and advisors.

The content and its compilation, created by Global Loyalty Organisation Ltd, are the property of Global Loyalty Organisation Ltd. and cannot be reproduced without prior written permission.