Splitit, the world's largest card-linked installment platform, powering thousands of merchants and millions of shoppers, announces the launch of FI-PayLater. Splitit will unlock its extensive merchant network to banks and card issuers (FIs) that wish to offer installment plans to existing customers, directly at the merchant checkout.

GLO

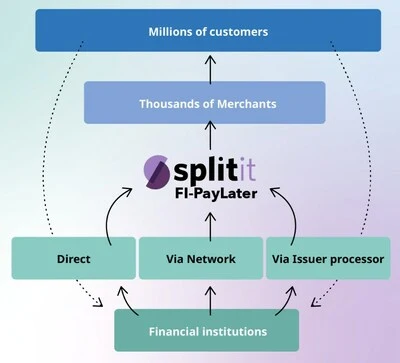

GLOSplitit, the world’s largest card-linked installment platform, powering thousands of merchants and millions of shoppers, announces the launch of FI-PayLater. Splitit will unlock its extensive merchant network to banks and card issuers (FIs) that wish to offer installment plans to existing customers, directly at the merchant checkout. Splitit’s groundbreaking solution, FI-PayLater, enables FIs to connect directly into Splitit, or connect via their existing card network, to drive incremental lending and fee income from BNPL use cases.

Traditionally, financial institutions (FIs) have struggled to unlock flexible payment options to their customers during the purchase journey. Instead, their offerings typically focus on “post-purchase” installment plans, which allow cardholders to split the cost of large purchases after they receive their statements. This approach has prevented FIs from tapping into the impulsive “during purchase” BNPL opportunity, successfully dominated by Buy Now, Pay Later (BNPL) fintech companies. By offering on demand flexible payment solutions at the point-of-sale, BNPL fintech providers are increasingly disrupting the traditional relationship between FIs and their customers.

“By enabling FIs to present compelling installment offers to their customers at the merchant checkout, we enable FIs to become relevant within the ‘during purchase’ installment market. Additionally, giving issuers the ability to pre-fund the merchants and charge the shopper driving new fee income in the environment of regulated interchange,” said Nandan Sheth, CEO, Splitit. “We’re allowing FIs to capitalize on their inherent advantages of scale, trust, and available credit within the installment economy.”

FI-PayLater changes the game by leveling the playing field. It empowers FIs to become key players in the “during purchase” BNPL market by allowing them to offer their existing customers installment plans directly at checkout, thereby enhancing their brand presence and providing customers with more choices from their trusted bank. Additionally, merchants experience increased sales driven by seamless, flexible payment options. This approach not only strengthens customer loyalty but also positions FIs as pivotal players in the evolving landscape of consumer finance.

The challenges facing issuers in today’s market are significant. With over 4,000 banks and credit unions in the United States alone, the adoption of diverse single-bank BNPL offerings poses a dilemma for merchants desiring integration and operating simplicity. FI-PayLater by Splitit addresses this issue head-on, offering a unified, easy to integrate solution that unlocks multiple FIs, thereby streamlining the process for adoption and ensuring a seamless experience for shoppers.

FI-PayLater offers turnkey capabilities that enable FIs to generate incremental fee income from existing relationships. FI-PayLater also offers multiple integration options, including direct connections, connections through payment networks, or integration via issuer processors.

Key Features:

- Unified merchant facing API standard; eCommerce plugins, POS SDK’s and single entry point for multiple FI installment programs

- End-to-end and modern experience emphasizing the FIs brand, within a streamlined checkout experience, designed to optimize sales conversion

- One-click installment selection at checkout with customizable preferences for such things as plan duration

- AI-powered waterfall, with dynamic shopper fees, on-demand card art, and risk parameters unique to each FI

- Embedded network installment programs including Visa’s (VIS) and MasterCard Installments

- Optionality for FIs or Splitit to pre-fund the merchant, and collect the installments from the shopper

- Merchant portal including reporting, exception management, and parameter setting across all participating issuers

- Issuer portal including reporting, transaction research and plan configuration options

Banks hold a natural advantage in the buy now, pay later (BNPL) market due to two key factors; (a) Lower Cost of Capital and (b) Existing Credit Relationships. FIs already have millions of pre-approved customers in the US (over 200 million). This reduces the burden to underwrite these consumers for new loans, reducing the risk of write-offs and promoting responsible spending.

FI-PayLater, becomes the key for FIs to capitalize on these strengths and seamlessly offer BNPL options through the Splitit orchestration engine, designed to shift the power back to FIs and merchants. Recent research by PYMNTS has shown that 66% of consumers want to consume installment offers before deciding what to buy, not after the fact. Further PYMNTS research also shows that 70% of current BNPL users say they would be interested in using BNPL plans from their banks if they were available.

Collin Flotta, Head of Product, Splitit added “Many FIs have expressed a strong desire for this type of solution, and we’ve responded by delivering it. Our single entry point and extensive network of merchant endpoints make FI-PayLater the easiest and most effective pay-later option for issuers to adopt, integrate, and operate across all consumer touchpoints, allowing us to lead the market and improve the economic model for all involved.”

As the retail and financial landscapes continue to evolve, FI-PayLater stands at the forefront, offering innovation to empower FIs while meeting the needs of today’s consumers and merchants alike. With Splitit, FIs can now meet the demand for flexible, in-checkout payment options, ensuring they remain integral players in the consumer finance journey.

About Splitit

Splitit powers the next generation of Buy Now, Pay Later (BNPL) through its merchant-branded Instalments-as-a-Service platform. Splitit is solving the challenges businesses face with legacy BNPL while unlocking BNPL at the point of sale for card networks, issuers and acquirers all through a single network API. Splitit’s Instalments-as-a-Service platform mitigates issues with legacy BNPL like the declining conversion funnel, clutter at the checkout and a lack of control of the merchant’s customer experience while putting the power back in the hands of merchants to nurture and retain customers, drive conversion and increase average order value. Splitit’s white-label BNPL is the easiest installment option for merchants to adopt, integrate and operate while delivering an uncluttered, simplified experience embedded into their existing purchase flow. Headquartered in Atlanta, Splitit has an R&D center in Israel and offices in London and Australia. Splitit is listed on the Australian Securities Exchange (ASX) under ticker code SPT and also trades on the US OTCQX under ticker SPTTY (ADRs) and STTTF (ordinary shares).

SOURCE Splitit USA, Inc.

Disclaimer: Press release

© Press Release 2025

Send us your press releases to news@globalloyalty.org

Press releases originate from external third-party providers. This website does not have responsibility or control over its content, which is presented as is, without any alterations. Neither this website nor its affiliates guarantee the accuracy of the views or opinions expressed in the press release.

The press release is intended solely for informational purposes and does not offer tax, legal, or investment advice, nor does it express any opinion regarding the suitability, value, or profitability of specific securities, portfolios, or investment strategies. Neither this website nor its affiliates are liable for any errors or inaccuracies in the content, nor for any actions taken based on it. By using the information provided in this article, you agree to do so at your own risk.

To the maximum extent permitted by applicable law, this website, its parent company, subsidiaries, affiliates, shareholders, directors, officers, employees, agents, advertisers, content providers, and licensors shall not be liable to you for any direct, indirect, consequential, special, incidental, punitive, or exemplary damages, including but not limited to lost profits, savings, and revenues, whether in negligence, tort, contract, or any other theory of liability, even if the possibility of such damages was known or foreseeable.

The images used in press releases and articles provided by 3rd party sources belong to the respective source provider and are used for illustrative purposes in accordance with the original press releases and publications.

Disclaimer: Content

While we strive to maintain accurate and up-to-date content, Global Loyalty Organisation Ltd. makes no representations or warranties of any kind, express or implied, about the correctness accuracy, completeness, adequacy, or reliability of the information or the results derived from its use, not that the content will meet your requirements or expectations. The content is provided “as is” and “as available”. You agree that your use of the content is at your own risk. Global Loyalty Organisation Ltd. disclaims all warranties related to the content, including implied warranties of merchantability, fitness for a particular purpose, non-infringement, and title, and is not liable for a particular purpose, non-infringement, and title, and is not liable for any interruptions. Some jurisdictions do not allow the exclusion of certain warranties, so these jurisdictions may not apply to you. Global Loyalty Organisation Ltd. Reserves the right to modify, interrupt, or discontinue the content without notice and is not liable for doing so.

Global Loyalty Organisation Ltd. shall not be liable for any damages, including special, indirect, consequential, or incidental damages, or damages for lost profits, revenue, or use, arising out of or related to the content, whether in contract, negligence, tort, statute, equity, law, or otherwise, even if advised of such damages. Some jurisdictions do not allow limitations on liability for incidental or consequential damages, so this limitation may not apply to you. These disclaimers and limitations apply to Global Loyalty Organisation Ltd. and its parent, affiliates, related companies, contractors, sponsors, and their respective directors, officers, members, employees, agents, content providers, licensors, and advisors.

The content and its compilation, created by Global Loyalty Organisation Ltd, are the property of Global Loyalty Organisation Ltd. and cannot be reproduced without prior written permission.